724% Return in 3 Years. Is it Right Time to Buy RVNL Share?

Introduction

In the tapestry of India's railway infrastructure, Rail Vikas Nigam Ltd (RVNL), a creation of the Government of India in 2003, stands as a pivotal player. Tasked with implementing diverse rail projects designated by the Ministry of Railways (MoR), RVNL weaves a narrative of progress and connectivity.

Key Offerings:

RVNL's portfolio spans the spectrum of rail development:

- New Lines: Expanding the rail grid, fostering a seamless bi-modal transportation network.

- Doubling: Alleviating traffic constraints by doubling existing routes.

- Gauge Conversion: Transforming meter gauge lines into broad gauge railway networks.

- Railway Electrification: Energizing un-electrified rail networks and electrifying new ones.

- Metropolitan Transport Projects: Initiating metro lines and suburban networks in bustling cities.

- Workshops: Crafting facilities for repairing and manufacturing rolling stock.

- Others: Constructing traffic facilities, ensuring railway safety, electrification projects, and more.

Revenue Dynamics:

In FY21, RVNL's revenue stream delineated:

- MOR Projects: 86%

- Non-Metro: 7%

- Deposit Work SPVs: 5%

- Others: 2%

Order Book and Project Prowess:

As of Q3FY22, RVNL boasted an order book of approximately Rs. 52,000 Cr, showcasing resilience through market bidding and nominations. With a track record of completing 120 projects and 72 underway, RVNL holds the reins to 195 assigned projects.

Securing Tomorrow's Journeys:

RVNL's prowess extends globally, with contracts pouring in for railway corridors, infra projects, metro station designs, and multi-modal logistics parks. Noteworthy orders hail from Tata Steel, NHAI, GMRCL, and even foreign entities like Kyrgyzstan.

RVNL isn't just a conduit of steel and tracks; it's a catalyst for progress, interconnecting landscapes and futures. As we delve deeper, RVNL's impact on the nation's mobility unfolds, revealing a story of transformation and connectivity on the rails of innovation.

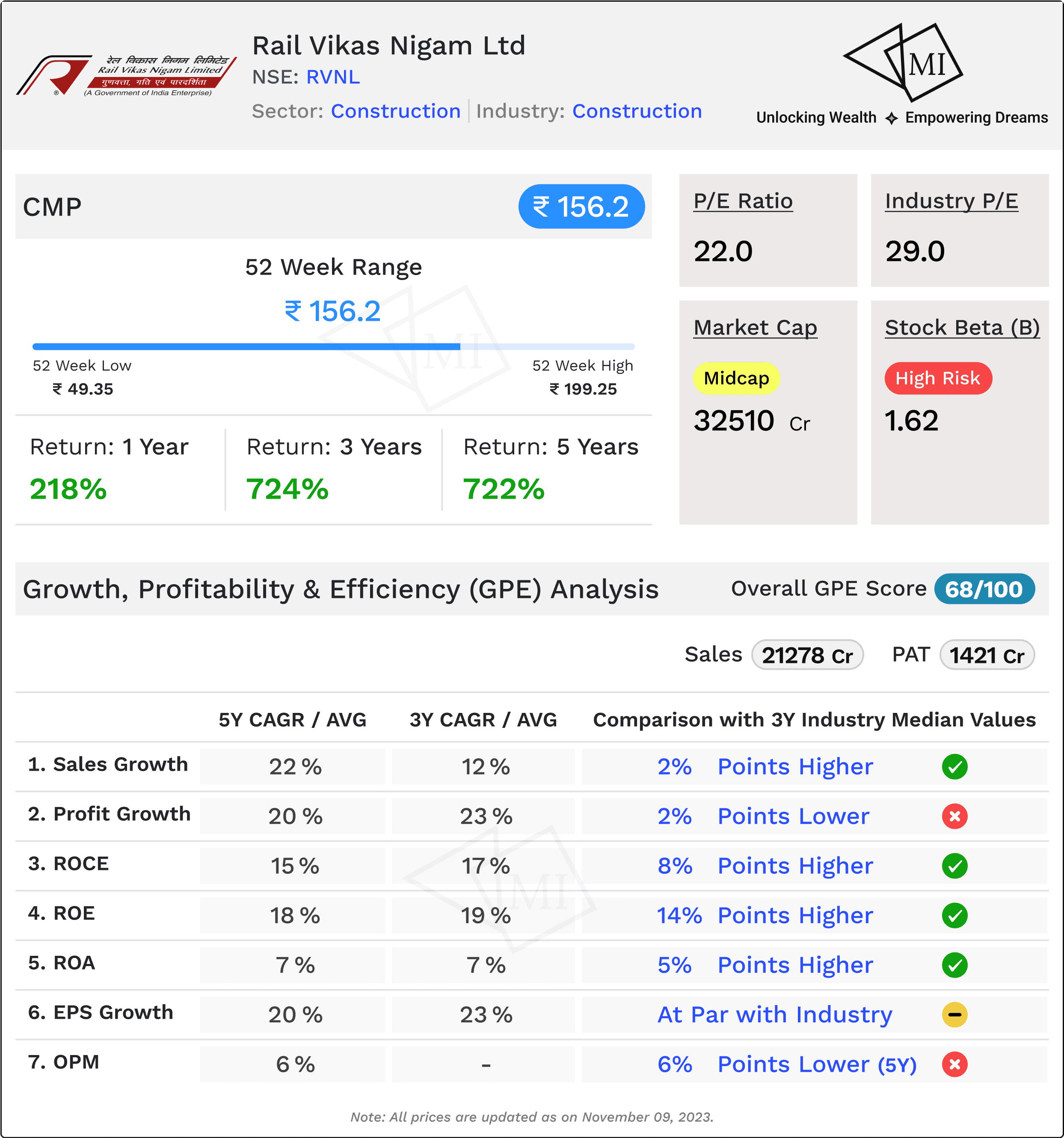

Growth, Profitability, and Efficiency (GPE) Analysis of RVNL

In the dynamic landscape of the railway sector, Rail Vikas Nigam Limited (RVNL) emerges as a key player, orchestrating growth, profitability, and operational efficiency. A comprehensive Growth, Profitability, and Efficiency (GPE) analysis sheds light on RVNL's performance against industry peers, unravelling the intricacies of its financial prowess.

1. Sales Growth:

RVNL's sales trajectory showcases robust performance, with a 12% 3-year Compound Annual Growth Rate (CAGR), surpassing peers by 2%. The 22% 5-year CAGR is even more impressive, standing 12% higher than the median of peers. This signals not only sustained growth but also a commendable lead in long-term revenue generation.

2. Profitability Metrics:

While the 3-year Profit CAGR of 23% is slightly lower than the peer median, RVNL compensates with a formidable 20% 5-year CAGR, outperforming peers by 4%. This dual perspective suggests a strategic approach to maintaining profitability over varying time horizons.

3. Return on Capital Employed (ROCE):

RVNL exhibits stellar financial efficiency with a 17% 3-year average ROCE, surpassing peers by 8%. The 15% 5-year average ROCE remains 7% higher than the peer median. These metrics underline RVNL's effective utilization of capital, translating into enhanced returns for investors.

4. Return on Equity (ROE):

RVNL's 3-year average ROE of 19% and 5-year average ROE of 18% both outshine peer medians by a significant margin, marking a commendable financial performance. These metrics underscore the company's ability to generate profits relative to shareholders' equity.

5. Return on Assets (ROA):

RVNL excels in asset utilization, boasting a 3-year average ROA of 7%, which is 5% higher than peer medians. The 6% higher 5-year average ROA reaffirms RVNL's proficiency in converting assets into profits.

6. Earnings Per Share (EPS) Growth:

RVNL's EPS growth mirrors industry peers closely, with a 23% 3-year growth rate and a slightly elevated 20% 5-year growth rate. This signifies a consistent and competitive performance in enhancing shareholder value through earnings.

7. Operating Margin:

While RVNL's 6% 5-year average operating margin falls 6% below the median of peers, this aspect warrants a deeper exploration. Operational nuances may be at play, and understanding the reasons behind this variance is crucial for a comprehensive assessment.

In conclusion, RVNL showcases commendable growth, profitability, and efficiency metrics, positioning itself as a formidable player in the railway infrastructure domain.

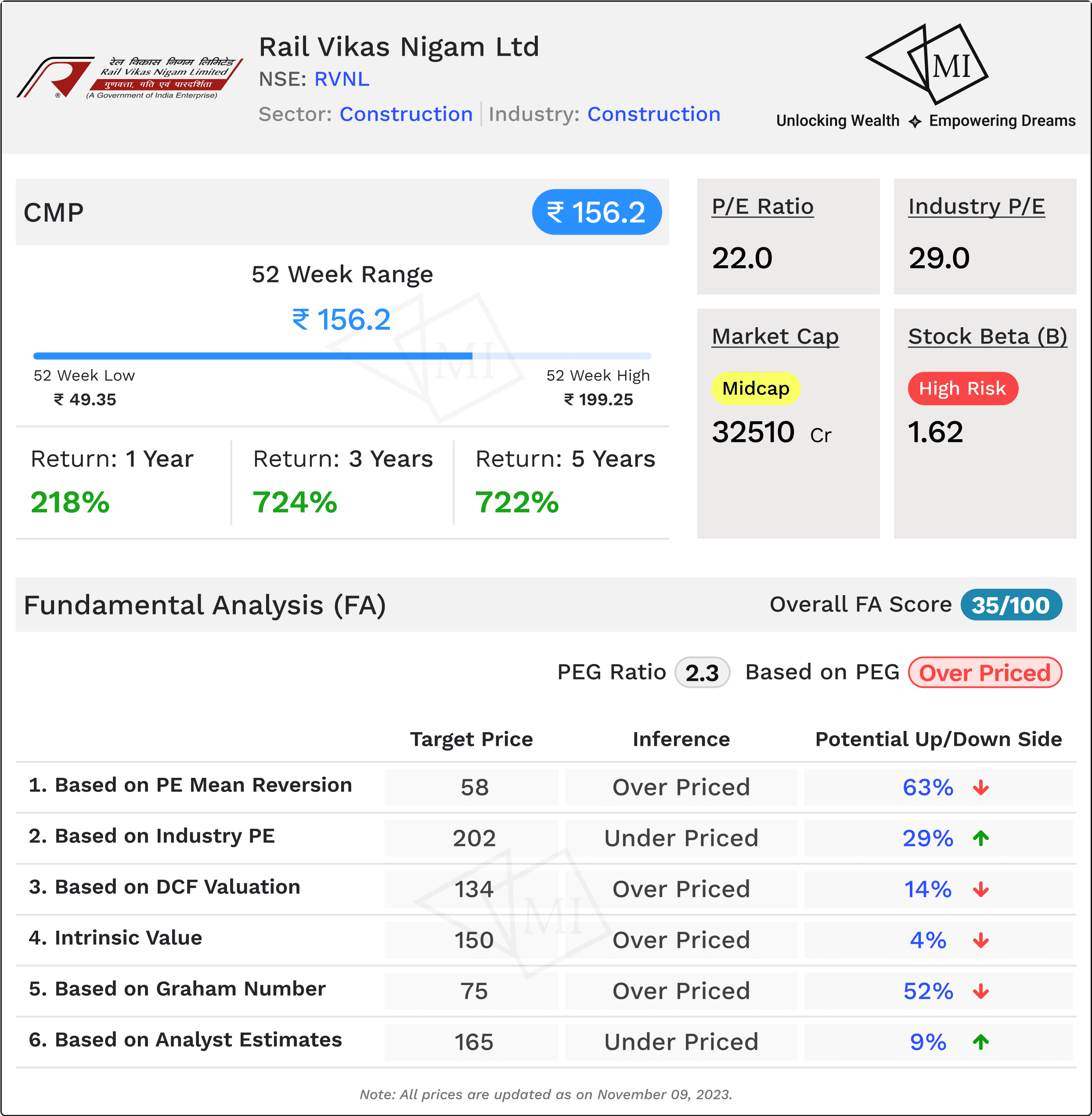

Fundamental Analysis (FA) of RVNL

Embarking on the investment journey with Rail Vikas Nigam Limited (RVNL) demands a meticulous exploration of its fundamental underpinnings. Fundamental analysis, a cornerstone of informed investment decisions, offers a lens through which we unravel the intrinsic value and potential trajectory of RVNL's share price.

1. Current Market Price and PEG Ratio:

As of now, RVNL's shares are trading at INR 156.2. The Price/Earnings to Growth (PEG) Ratio, standing at 2.3, signals a potential overpricing, indicating that investors might be paying more for the growth prospects relative to the stock's earnings performance.

2. Expected Share Price based on PE Mean Reversion:

A calculated PE mean reversion analysis proposes an expected share price for RVNL at INR 58, showcasing a stark potential downside of 63%. This inference suggests caution, as the current market price may not align with the historical earnings trends.

3. Expected Share Price based on Industry PE:

Contrarily, a glance at the industry PE reveals a potential upside for RVNL. With an expected share price of INR 202 based on industry median, there's an enticing 29% potential upside, highlighting the possibility that RVNL might be undervalued relative to its industry peers.

4. Fair Value as per DCF Valuation:

A Dive into Discounted Cash Flow (DCF) valuation, in a base-case scenario, positions the fair value for RVNL at INR 134. Despite indicating an overpriced status, the potential downside of 14% suggests a more moderate correction compared to the PE mean reversion.

5. Intrinsic Value:

Delving into intrinsic value considerations, the calculated figure for RVNL stands at INR 150. This estimation hints at a potential downside of 4%, aligning closely with the DCF valuation and indicating a more balanced valuation metric.

6. Target Price as per Analyst Estimate:

Analyst estimates forecast a target price for RVNL at INR 165, implying an intriguing 9% potential upside. This divergence between the analyst consensus and other valuation methods adds a layer of complexity, urging investors to scrutinize the rationale behind these estimates.

7. Fair Value as per Graham Number:

Finally, the Graham Number methodology paints a sobering picture, suggesting a fair value for RVNL at INR 75 and a substantial potential downside of 52%. This conservative approach underscores the importance of multiple perspectives in fundamental analysis.

In conclusion, the fundamental analysis of RVNL presents a nuanced narrative. While certain indicators signal potential overvaluation, others suggest an undervalued status.

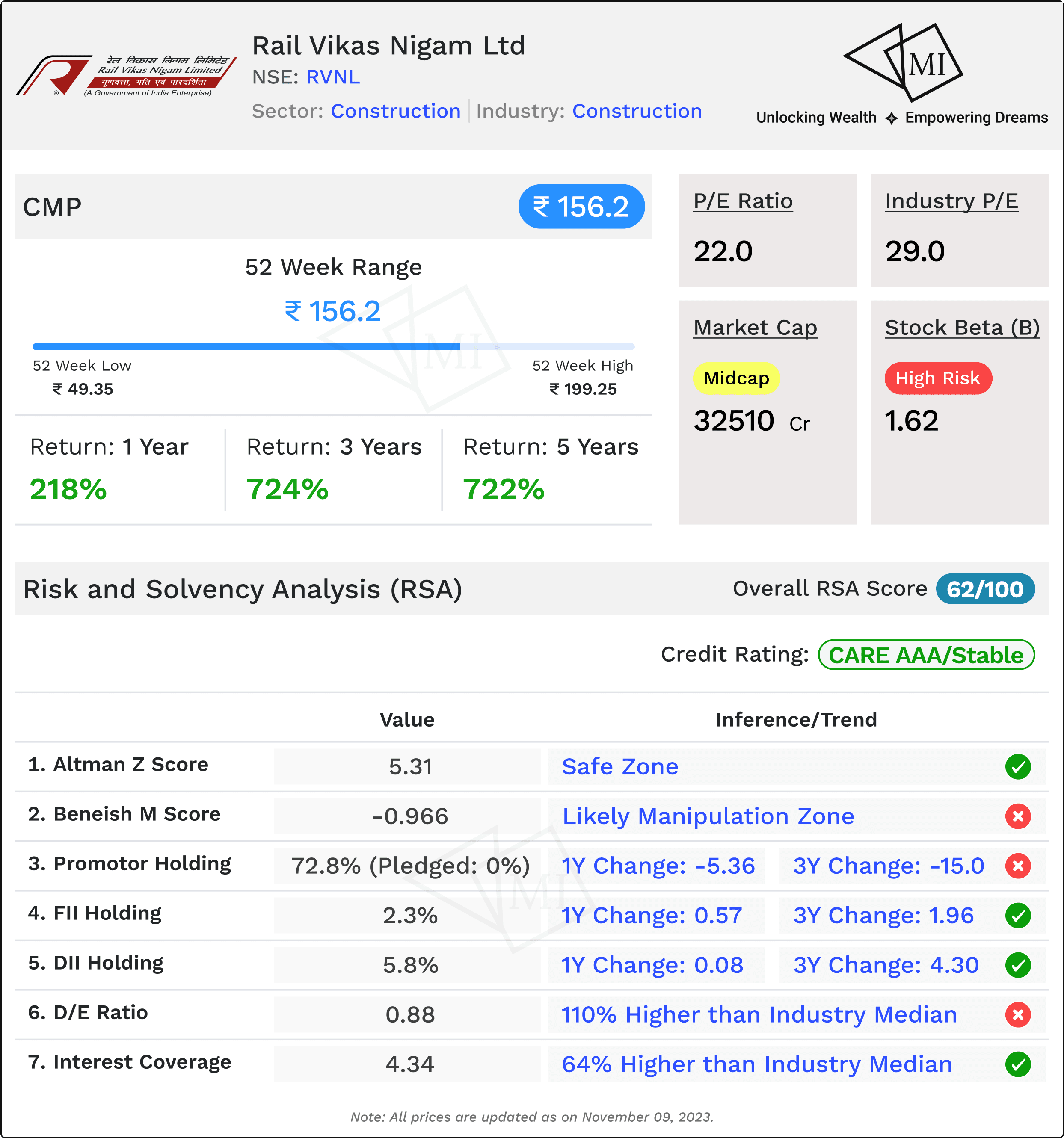

Risk and Solvency Analysis (RSA) of RVNL

Investing in Rail Vikas Nigam Limited (RVNL) demands a comprehensive understanding of the risks it faces and its solvency standing. A detailed Risk and Solvency Analysis provides investors with a crucial perspective on the company's financial robustness and the potential challenges it might encounter.

1. Stock Beta: High Risk, High Reward?

RVNL's stock beta of 1.62 signals high volatility, implying that its share prices are expected to be more sensitive to market fluctuations. While high beta can result in higher returns, it also exposes investors to increased market risk.

2. Long-Term Credit Rating: Stability Amidst Risk

Despite the perceived market risk, RVNL's long-term credit rating by CARE stands at AAA with a stable outlook. This rating suggests a strong capacity to meet financial commitments, providing investors with a sense of stability amidst market dynamics.

3. Altman Z Score: Navigating the Safe Zone

The Altman Z Score, a measure of a company's financial health, stands at a robust 5.31, placing RVNL comfortably in the safe zone. This score reflects a low likelihood of financial distress in the near future, providing assurance to investors.

4. Beneish M Score: Uncovering Potential Manipulation

The Beneish M Score of -0.966 raises a cautionary flag, indicating a potential zone of manipulation. While not conclusive evidence, investors should tread carefully and conduct additional due diligence, recognizing the need for a nuanced assessment.

5. Promoter and Institutional Holdings: Stability and Changes

Promoter holding, at 72.8%, remains strong with no pledged shares. However, a 5.36% reduction in the past year and a significant 15% reduction over the last three years may warrant scrutiny. Meanwhile, FII and DII holdings, though relatively low, exhibit stable trends with modest changes.

6. Debt-to-Equity Ratio (D/E): Elevated, But Manageable?

RVNL's D/E ratio of 0.88 is 110% higher than the industry median, indicating a higher reliance on debt. However, the ratio remains below 1, suggesting a manageable debt load. Investors should monitor the company's ability to service its debt obligations.

7. Interest Coverage Ratio (ICR): Above Industry Norms

With an ICR of 4.34, RVNL exhibits a healthy ability to cover its interest expenses. This figure, 64% higher than the industry median, provides reassurance regarding the company's solvency.

In conclusion, RVNL's Risk and Solvency Analysis unveils a mix of strengths and considerations. While the company faces elevated market risk and potential manipulation signals, its strong credit rating, Altman Z Score, and stable institutional holdings provide a balancing perspective.

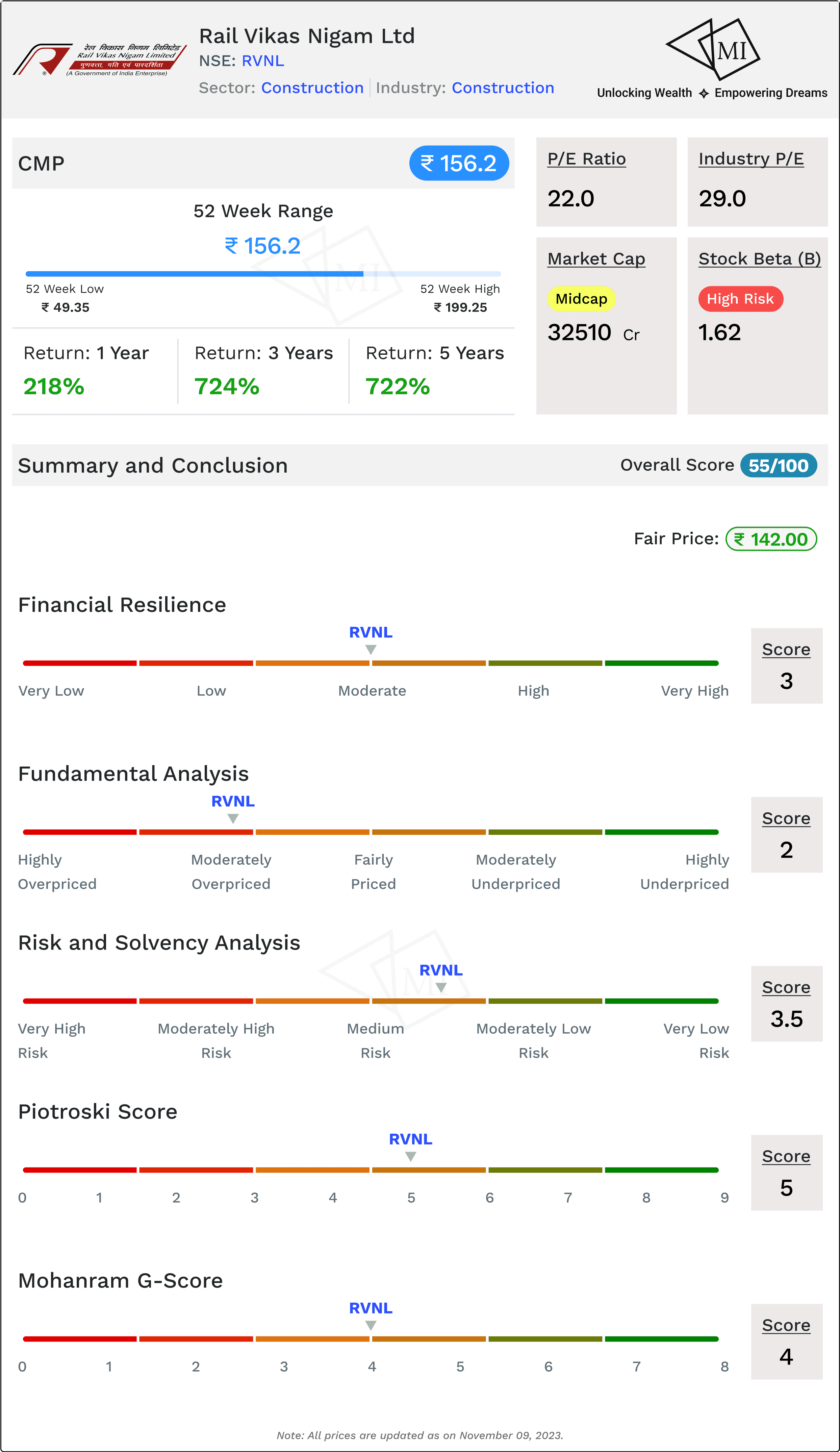

Summary and Conclusion: Recap and Final Thoughts on RVNL

As we journey through the intricacies of Rail Vikas Nigam Limited (RVNL), the numbers paint a compelling portrait of the company's financial landscape. Let's distill the analysis into a comprehensive summary, bringing together the various scores and indicators.

1. Financial Resilience Score: Weathering the Storms

RVNL demonstrates commendable financial resilience, scoring 3 out of 5. This indicates a moderate ability to navigate economic uncertainties, reflecting stability in the company's financial foundations.

2. Fundamental Analysis Score: A Mosaic of Metrics

In the realm of fundamental analysis, RVNL earns a score of 2 out of 5. While this score reflects a moderate standing, it underscores the importance of scrutinizing key financial aspects to gain a nuanced understanding of the company's performance.

3. Risk and Solvency Analysis Score: Balancing Act

RVNL strikes a balance in risk and solvency, garnering a score of 3.5 out of 5. This suggests a company that acknowledges and manages risks effectively while maintaining a robust solvency position.

4. Piotroski Score: Average Performer

The Piotroski Score of 5 positions RVNL as an average performer in terms of financial health and operational efficiency. While not the highest score, a 5 indicates a reasonable level of confidence in the company's financial integrity.

5. Mohanram G-Score: A Moderate Seal of Approval

With a Mohanram G-Score of 4, RVNL secures a moderate seal of approval. This score, falling between the extremes, suggests a company that navigates the financial landscape with a reasonable level of acumen.

Overall Score: A Holistic Perspective

As we aggregate these scores, RVNL emerges with an overall score of 55 out of 100. This composite score offers a holistic perspective, combining financial resilience, fundamental analysis, risk management, and additional performance indicators.

Fair Price Assessment: Navigating Market Dynamics

The fair price for RVNL stock is estimated at 142, while the current market price stands at 156.2. This juxtaposition suggests that, based on the analyzed metrics, the market might be pricing RVNL shares slightly above what is deemed fair value.

Conclusion: Navigating Opportunities with Caution

In conclusion, RVNL appears to be a company with a balanced financial profile, demonstrating resilience in the face of challenges. However, the nuanced scores and fair price assessment underline the importance of careful consideration before making investment decisions.

Information on Multibagger Investments is for educational purposes only and should not be considered financial advice. Users should conduct their own research and seek professional advice before making investment decisions.

Frequently Asked Questions

संबंधित लेख

157% Return in 3 Years. Is IDFC First Bank share good to buy for long term?

22% Return in 3 Years. Is Yes Bank share worth buying?