22% Return in 3 Years. Is Yes Bank share worth buying?

Introduction

Incorporated in 2003, Yes Bank Ltd has emerged as a key player in the banking and financial services sector, offering a comprehensive suite of products and digital solutions. As a full-service commercial bank, Yes Bank caters to a diverse clientele, spanning retail, MSME, and corporate segments.

Business Overview: Yes Bank's footprint extends across India with 1,192 branches, 150 BCBO, and a vast network of 1,300+ ATMs, showcasing its commitment to serving over 300 districts. Its influence stretches beyond national borders, boasting a representative office in Abu Dhabi and an IFSC Banking Unit in Gujarat International Finance Tec-City (GIFT). Operating under the umbrella of YES Securities, a wholly-owned subsidiary, the bank seamlessly integrates investment banking, merchant banking, and brokerage services.

Key Financial Metrics - FY23: Yes Bank's financial health, as of FY23, is characterized by notable metrics, including a Net Non-Performing Asset (NNPA) at ~0.8%, Gross Non-Performing Asset (GNPA) at ~2.2%, and a robust CASA ratio of ~30.8%. The bank has achieved a significant milestone with 1.3 million+ new CASA customers annually, contributing to a retail advances portfolio of ~Rs. 90,000 Crore, constituting 45% of Net Advances.

Retail Book - FY23: The bank's retail book composition reflects a diversified portfolio, with Mortgage Loans leading at ~33%, followed by Auto Loans at ~18%, Consumer Loans at ~23%, and Commercial Loans at ~23%.

Past Issues and Reconstruction: Yes Bank faced challenges in the past, grappling with high GNPA ratios due to defaults on corporate advances to prominent groups. In response, the Reserve Bank of India (RBI) intervened in March 2020, superseding the Board of Directors and appointing Prashant Kumar as the administrator. A reconstruction scheme, backed by private and public institutions, injected equity into the bank, preventing a collapse and ensuring stability.

Latest Developments: Recent milestones include the addition of 83 new branches in FY23, partnerships with Aadhar Housing Finance for home finance solutions, and the issuance of the first Electronic Bank Guarantee. Yes Bank continues to innovate, becoming the first bank in the Asia Pacific to introduce a debit card on Mastercard's premium World Elite Platform.

Despite its tumultuous past, Yes Bank has demonstrated resilience and adaptability, evolving into a dynamic financial institution poised for a promising future. In the subsequent sections of this article, we delve deeper into Yes Bank's performance through various analytical lenses to help investors navigate the complexities and make informed decisions.

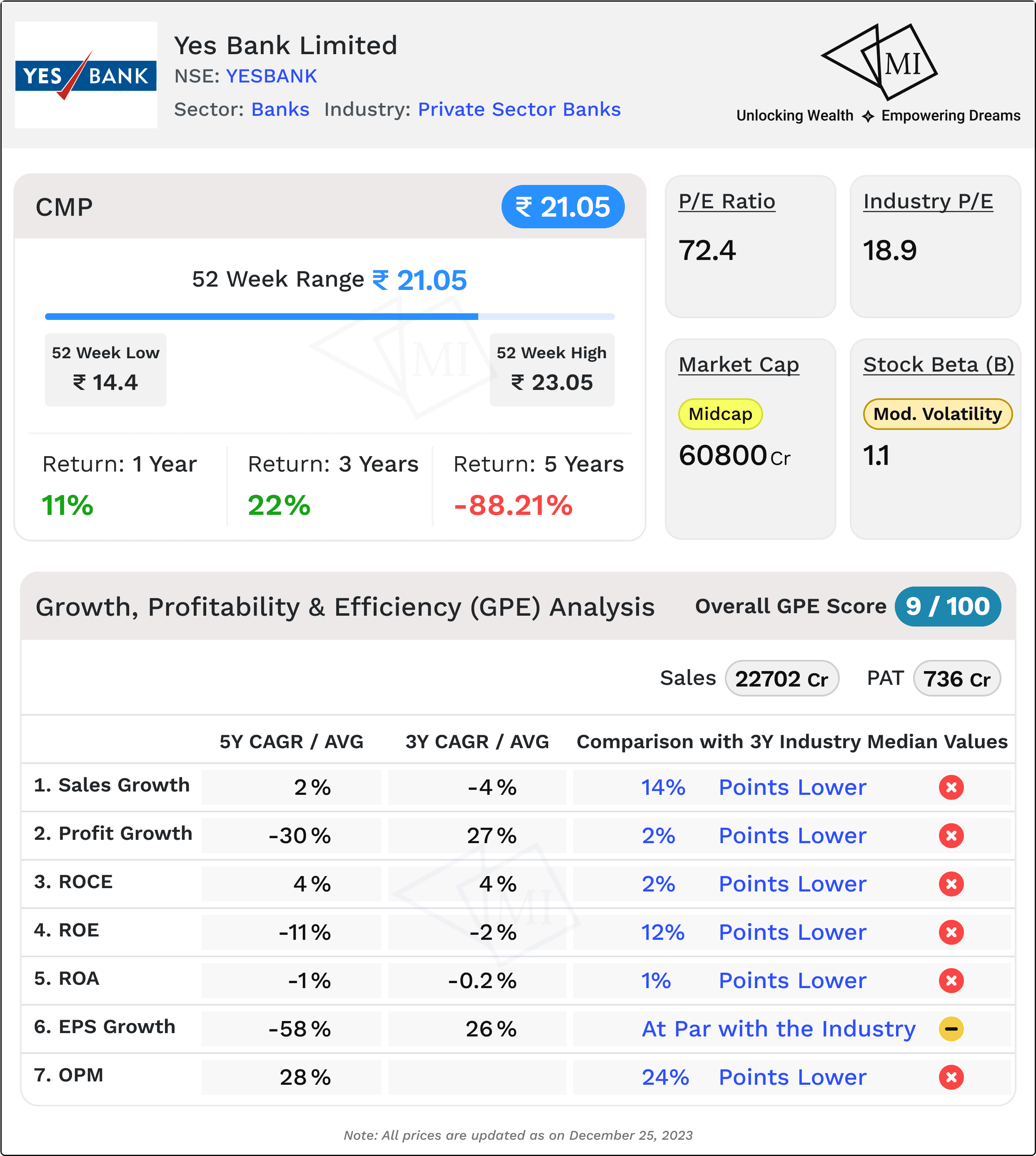

Growth, Profitability, and Efficiency (GPE) Analysis of Yes Bank

Understanding the Growth, Profitability, and Efficiency (GPE) metrics is crucial for assessing the financial health and future prospects of a company. In the case of Yes Bank, a comprehensive analysis reveals a mixed bag of performance indicators when compared to its peer group.

1. Sales Growth: A Tale of Challenges

Yes Bank has experienced a challenging sales trajectory with a 3-year CAGR of -4%, significantly lagging behind the peer group median by 14 percentage points. The 5-year CAGR at 2% is marginally better but still trails by 10 percentage points. This indicates a need for strategic initiatives to boost sales and align with industry trends.

2. Profits Rollercoaster: A Call for Stability

Profits at Yes Bank present a mixed picture. While the 3-year CAGR stands at a commendable 27%, it falls short by 2 percentage points compared to the peer group median. However, the 5-year CAGR of -30% raises concerns, being a staggering 56 percentage points lower than the median. Ensuring sustained profitability is imperative for the bank's long-term viability.

3. ROCE and ROE: Margins for Improvement

Return on Capital Employed (ROCE) and Return on Equity (ROE) are pivotal metrics for evaluating a company's efficiency. Yes Bank's 3-year and 5-year averages for ROCE are both at 4%, trailing the peer group median by 2 percentage points. ROE, on the other hand, paints a concerning picture with averages of -2% and -11% respectively, lagging behind the median by 12 and 21 percentage points. Enhancing these figures will be key for maximizing shareholder value.

4. ROA: Efficiency in Asset Utilization

Return on Assets (ROA) reflects how efficiently a company utilizes its assets to generate earnings. Yes Bank's 3-year and 5-year averages, at -0.2% and -1.1% respectively, indicate a slight inefficiency compared to the peer group median. Addressing factors impacting asset efficiency can contribute to overall performance improvement.

5. EPS Growth: Seeking Stability

Earnings Per Share (EPS) growth at Yes Bank shows a 3-year growth of 26%, aligning with the peer group median. However, the 5-year growth of -58% is alarming, being 83 percentage points lower than the median. Achieving stability in EPS growth is vital for building investor confidence.

6. Operating Margin: Navigating Challenges

Yes Bank's 5-year average operating margin stands at 28%, trailing the peer group median by a significant 24 percentage points. Enhancing operational efficiency and cost management will be critical for narrowing this gap and ensuring sustained profitability.

In conclusion, Yes Bank faces challenges in various GPE metrics, indicating the need for strategic initiatives to enhance sales, stabilize profits, and improve efficiency metrics. Investors should closely monitor the bank's efforts in addressing these challenges to make informed decisions in an ever-evolving financial landscape.

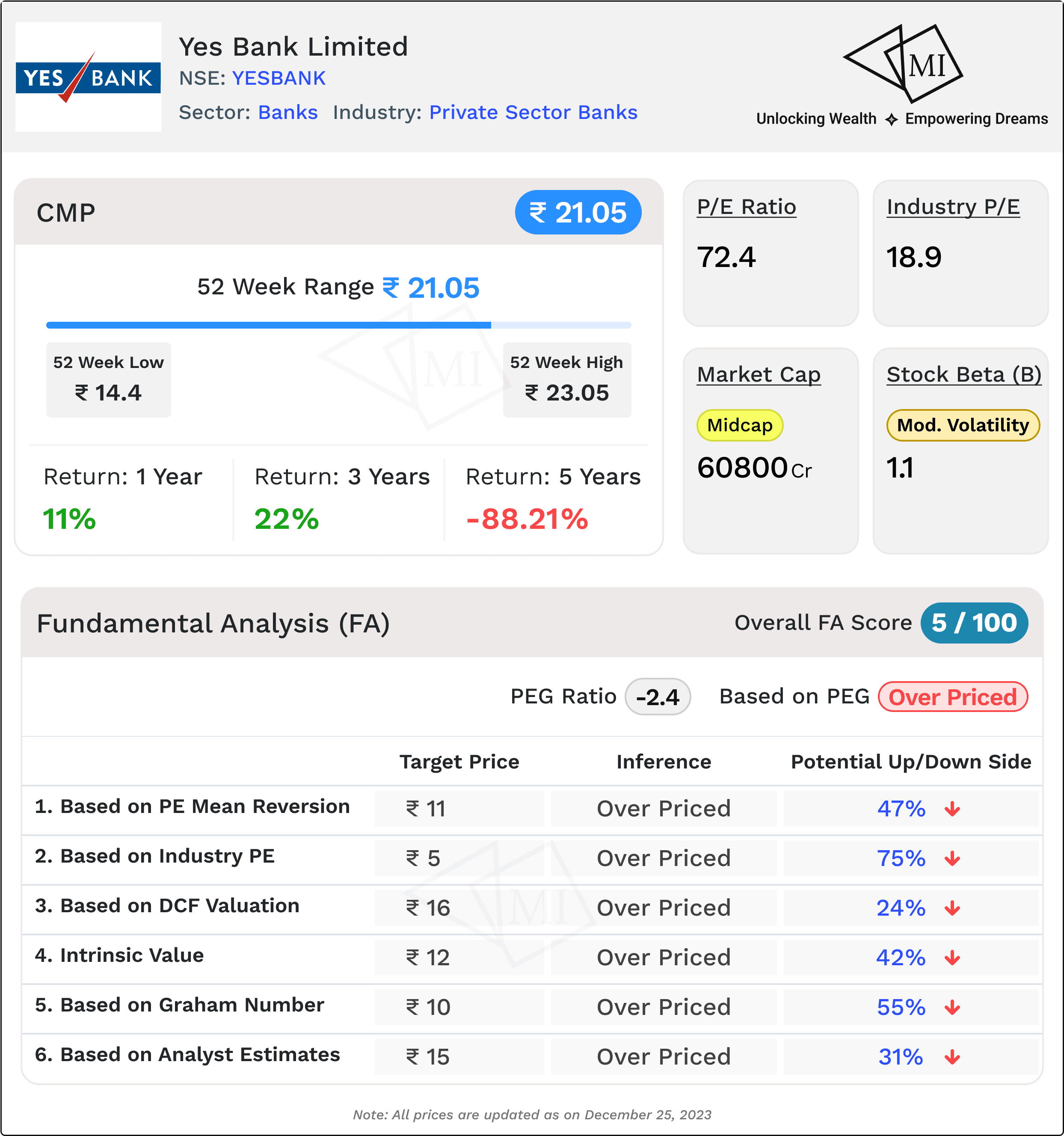

Fundamental Analysis (FA) of Yes Bank

Understanding the fundamental aspects of Yes Bank is essential for investors seeking a comprehensive view of the stock's valuation. Let's delve into various metrics that shed light on the current state and potential future trajectory of Yes Bank's share price.

1. Current Market Price and PEG Ratio: A Snapshot

The current market price of Yes Bank stands at INR 21, but the PEG ratio raises eyebrows at -2.44, indicating that the stock might be overpriced. The PEG ratio, which considers the Price to Earnings (PE) ratio and the expected growth rate, suggests caution in evaluating Yes Bank's investment potential.

2. Expected Share Price based on PE Mean Reversion: INR 11

An analysis of PE mean reversion hints at an expected share price of INR 11 for Yes Bank, signalling an overpricing of the stock with a potential downside of 47%. Investors should be wary of the implications of such a significant deviation from the mean.

3. Expected Share Price based on Industry PE: INR 5

Considering the industry PE, the expected share price of Yes Bank drops to INR 5, revealing an overvaluation of Yes Bank with a substantial potential downside of 75%. This emphasizes the importance of contextualizing the stock's performance within the broader industry landscape.

4. Fair Value as per DCF Valuation (Base Case Scenario): INR 16

Employing a discounted cash flow (DCF) valuation in a base case scenario for Yes Bank yields a fair value of INR 16. Although this suggests a lower potential downside of 24%, it still indicates that the stock might be overpriced. Investors should scrutinize the underlying assumptions in DCF models for a nuanced understanding.

5. Intrinsic Value (Base Case Scenario): INR 12

Assessing the intrinsic value of Yes Bank in a base case scenario reveals a value of INR 12, pointing towards an overpriced stock with a potential downside of 42%. This valuation metric underscores the importance of evaluating the core value of the company's operations.

6. Fair Value as per Graham Number: INR 10

The Graham Number, a valuation metric devised by Benjamin Graham, sets the fair value for Yes Bank at INR 10. This implies an overvaluation of Yes Bank with a potential downside of 55%. Investors should consider the conservative nature of the Graham Number in their decision-making process.

7. Average Target Price as per Analyst Estimate: INR 15

Analyst estimates converge at an average target price of INR 15 for Yes Bank, signalling an overpriced stock with a potential downside of 31%. While analyst consensus is valuable, investors should conduct their due diligence and validate these estimates against other fundamental indicators.

In conclusion, the fundamental analysis paints a cautionary picture for Yes Bank's share price. Multiple valuation metrics suggest an overpricing of the stock, prompting investors to carefully assess the risk-reward profile before making investment decisions. It's crucial to recognize the dynamic nature of financial markets and consider various factors when determining the intrinsic value of a stock.

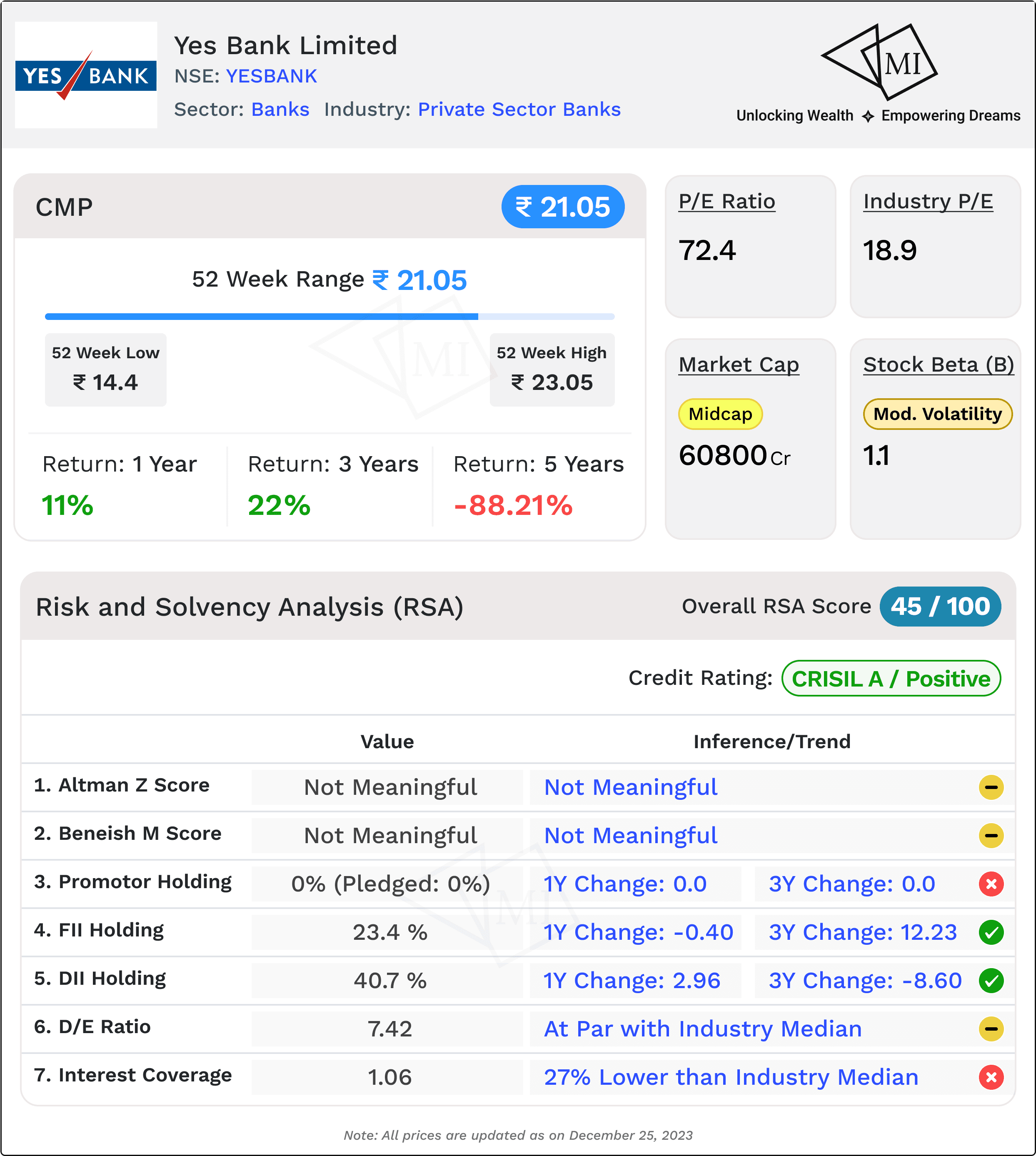

Risk and Solvency Analysis (RSA) of Yes Bank

Understanding the risk and solvency profile of Yes Bank is paramount for investors seeking a well-rounded assessment of the institution's stability and resilience. Let's delve into various indicators that shed light on the risk factors and solvency metrics associated with Yes Bank.

1. Stock Beta: 1.1 - Moderate Volatility

Yes Bank exhibits moderate volatility with a Stock Beta of 1.1. Investors should be aware of the potential price fluctuations associated with this level of beta, as it signifies a degree of sensitivity to market movements.

2. Long Term Credit Rating: CRISIL A/Positive

Yes Bank holds a Long Term Credit Rating of CRISIL A/Positive, indicating a solid credit standing. This rating suggests a relatively low credit risk, reflecting the institution's ability to meet its long-term financial obligations.

3. Altman Z Score: 0.82 - Not Meaningful for Banks

The Altman Z Score, commonly used to assess the financial health of non-financial companies, is not considered meaningful for banks. Investors should rely on other metrics tailored to the banking industry for a more accurate evaluation.

4. Beneish M Score: Not Estimated - Not Meaningful for Banks

Similar to the Altman Z Score, the Beneish M Score is not estimated for banks. Investors should focus on relevant indicators specific to the banking sector for a comprehensive solvency analysis.

5. Promoter Holding: 0% (0% Pledged)

Yes Bank's Promoter Holding stands at 0%, with no shares pledged.

6. FII Holding: 23.4% (1Y Change: -0.4%, 3Y Change: 12.23%)

Foreign Institutional Investors (FIIs) hold a significant stake of 23.4% in Yes Bank. While there has been a slight decrease in the past year (-0.4%), the 3-year change reflects a positive trend with a 12.23% increase. This indicates foreign investor confidence in the bank's prospects.

7. DII Holding: 40.7% (1Y Change: 2.96%, 3Y Change: -8.60%)

Domestic Institutional Investors (DIIs) have a substantial holding of 40.7%. The 1-year change shows a moderate increase of 2.96%, while the 3-year change indicates a decrease of -8.60%. Monitoring institutional investor sentiment is crucial for understanding market perceptions.

8. D/E Ratio: 7.42 - At Par with Industry Median

Yes Bank's Debt-to-Equity (D/E) Ratio stands at 7.42, aligning with the industry median. While this ratio indicates a significant debt burden, it's important to note that it is in line with industry norms.

9. ICR (Interest Coverage Ratio): 1.06 - 27% Lower than Industry Median

The Interest Coverage Ratio (ICR) at 1.06 is 27% lower than the industry median of 1.46. This suggests a relatively lower capacity for Yes Bank to cover its interest obligations, indicating a potential solvency concern.

In conclusion, Yes Bank presents a mix of positive and concerning indicators in its risk and solvency profile. Investors should carefully consider the stability of institutional holdings, debt levels, and interest coverage when assessing the bank's ability to weather economic fluctuations. It's crucial to stay attuned to changes in these metrics as they can greatly impact the bank's resilience in dynamic market conditions.

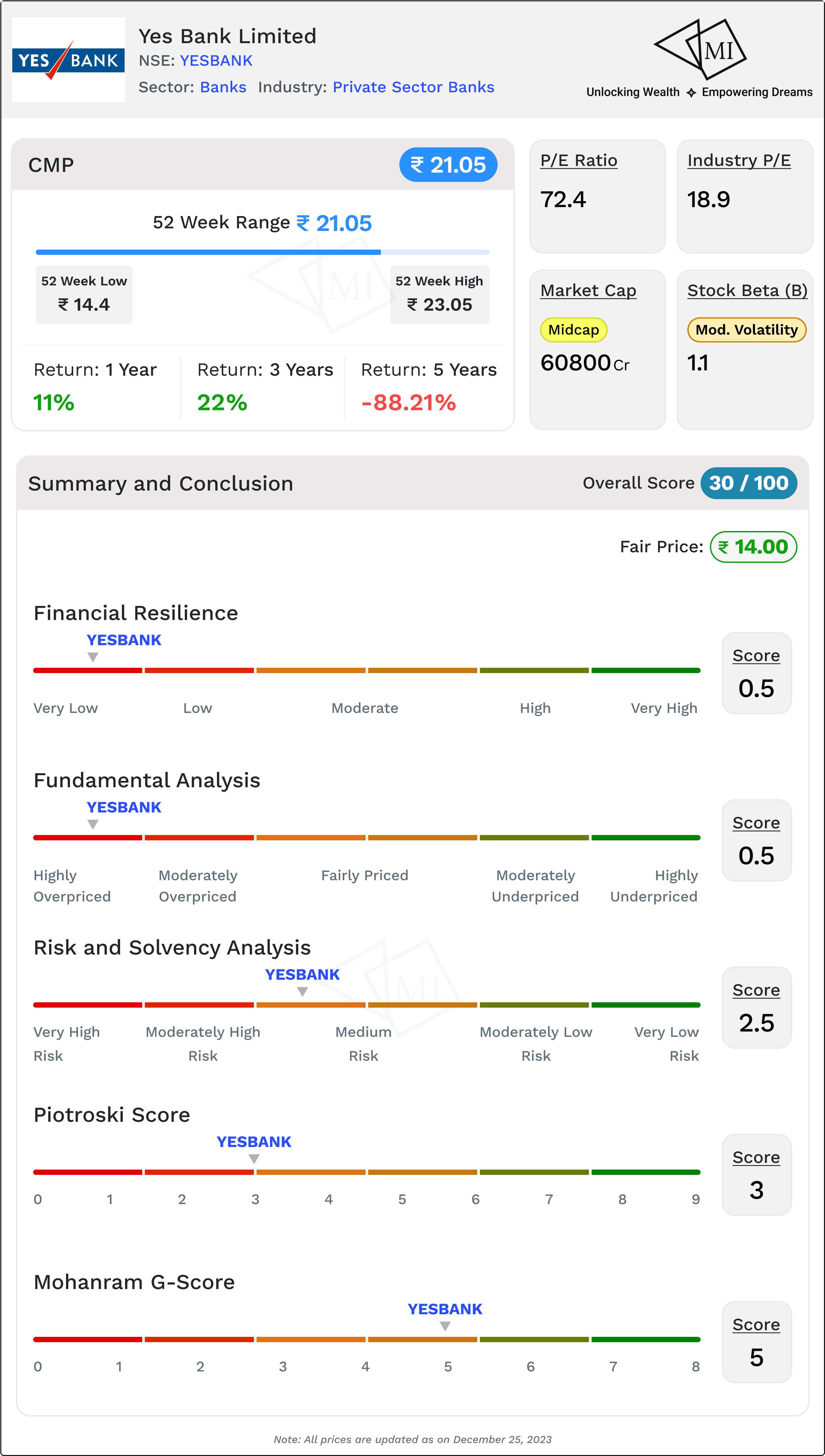

Summary and Conclusion: Recap and Final Thoughts on Yes Bank

As we conclude our exploration into the dynamics of Yes Bank's share price, a comprehensive evaluation reveals a nuanced picture that investors should consider in their decision-making process. Let's recap the key findings across various analyses.

1. Financial Resilience: 0.5 on 5

Yes Bank's financial resilience score, standing at 0.5 on a scale of 5, indicates a fragile financial position. This underscores the challenges the bank faces in terms of its ability to withstand economic downturns and uncertainties.

2. Fundamental Analysis: 0.5 on 5

The fundamental analysis score, mirroring the financial health and performance of Yes Bank, stands at 0.5 out of 5. This suggests that the bank faces significant challenges in terms of growth, profitability, and efficiency, as highlighted in the analysis.

3. Risk and Solvency Analysis: 2.5 on 5

The risk and solvency analysis score, at 2.5 out of 5, provides insights into the bank's stability and ability to manage risks. While there are areas of concern, such as the interest coverage ratio and debt levels, there are also positive indicators, including credit ratings and institutional holdings.

4. Piotroski Score: 3 (Low)

The Piotroski Score, an indicator of financial strength, reveals a score of 3, categorizing Yes Bank's financial strength as low. This underscores challenges in areas such as profitability, leverage, and operating efficiency.

5. Mohanram G-Score: 5 (Average)

The Mohanram G-Score, evaluating the likelihood of financial manipulation, yields a score of 5, indicating an average level of susceptibility to manipulation. While not alarming, investors should remain vigilant and consider this aspect in their decision-making.

Overall Score: 30 on 100, Fair Price for Stock: INR 14

Combining these diverse metrics, the overall score for Yes Bank stands at 30 out of 100. This composite score, reflecting the bank's performance across various dimensions, suggests caution. The fair price for the stock is estimated at INR 14, notably lower than the current market price of INR 21.

In conclusion, Yes Bank presents a challenging investment landscape, marked by financial fragility, operational concerns, and potential solvency issues. Investors should carefully weigh the risks and rewards, considering the fair price estimate and the broader economic context. While the bank shows signs of improvement in certain areas, it remains crucial for investors to conduct thorough due diligence and stay informed about developments that may impact Yes Bank's future trajectory.

Information on Multibagger Investments is for educational purposes only and should not be considered financial advice. Users should conduct their own research and seek professional advice before making investment decisions.

Frequently Asked Questions

સંબંધિત લેખો

157% Return in 3 Years. Is IDFC First Bank share good to buy for long term?

Nearing 52 Week Low Mark. Is it Good Time to Buy Adani Wilmar Share?