Upto 150% Upside Potential by FY25. Is this Emerging Chemical Sector Multibagger in Your Portfolio?

Introduction

In the dynamic landscape of chemical manufacturing, Archean Chemical stands as a titan, crafting its legacy as the largest exporter of bromine and industrial salt in India. Boasting one of the lowest global production costs in both bromine and industrial salt, the company is a beacon of efficiency and innovation.

A Diverse Product Portfolio

Archean Chemical's revenue streams are as diverse as they are dynamic. In FY23, marine chemical salt comprised 49%, bromine contributed 50%, and sulphate of potash made up 1% of the revenue. This strategic product mix reflects Archean's adeptness at capturing opportunities across varied market segments.

Dominance in Bromine and Strategic Expansion

Archean commands leadership in Indian bromine merchant sales, exporting a significant portion to China. The company's prowess is exemplified by its ownership and leasing of 228 specialized ISO containers, essential for the safe transportation of bromine. Not resting on laurels, Archean is actively expanding, with a Rs. 250 crores investment in a bromine derivatives plant and a capacity increase to 42,500 MTPA in January 2023.

Industrial Salt: A Pillar of Strength

Archean Chemical stands tall as the largest exporter of industrial salt in India, with exports reaching 2.7 million MT in FY21. The company's industrial salt-washing facility, one of the world's largest, plays a crucial role in chlorine and caustic soda production. With plans to expand manufacturing capacities, Archean is fortifying its position as a key player in the industrial salt market.

Unique Expertise in Sulphate of Potash

As the sole manufacturer of sulphate of potash from natural sea brine in India, Archean exports 70% of its produce. This high-end fertilizer and medical-grade compound showcase Archean's commitment to innovation and meeting diverse market demands.

Integrated Production Facility: A Hub of Excellence

Archean's manufacturing facility in Hajipir, Gujarat, is the nucleus of its operations. Spanning approximately 240 sq. km, it houses the integrated production of bromine, industrial salt, and sulphate of potash. With installed capacities of 28,500 MTPA, 3,000,000 MTPA, and 130,000 MTPA, respectively, this facility is a testament to Archean's commitment to scale and efficiency.

Global Footprint and Customer Trust

Geographically, Archean's revenue mix showcases a balanced approach, with 66% generated outside India in FY23. With a diverse clientele of 66, including 29 global clients, the company's largest customer comprises 29% of its revenue, demonstrating a well-distributed and robust customer base.

As we delve deeper into Archean Chemical's financial resilience, fundamental strength, and risk management strategies, the intricate tapestry of this industry leader becomes even more apparent. Stay tuned as we unravel the layers of Archean's financial prowess and market dominance in our upcoming sections.

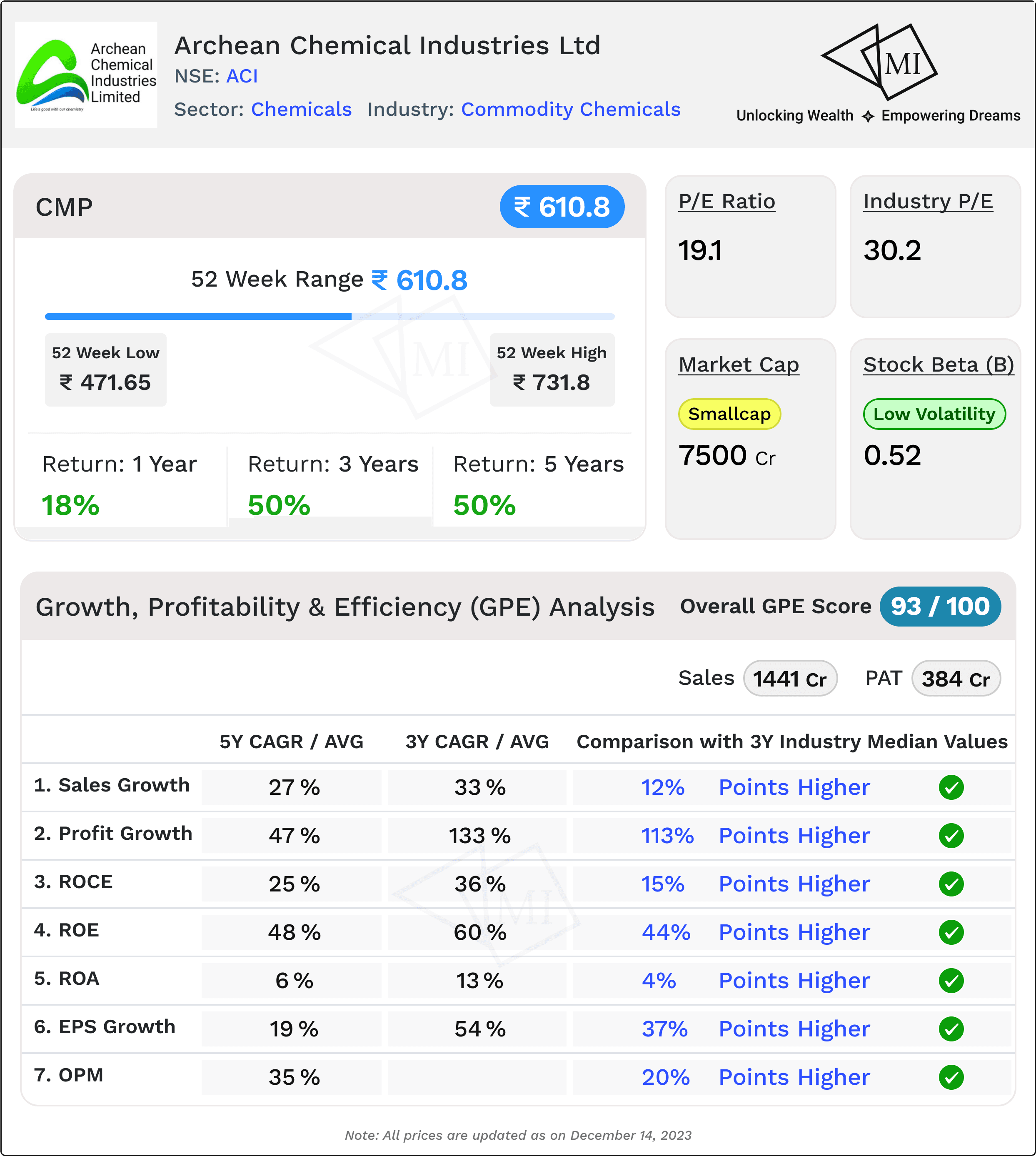

Growth, Profitability, and Efficiency (GPE) Analysis of Archean Chemical

Archean Chemical stands as a beacon of exceptional performance in the chemical industry, outshining its peers in the realms of growth, profitability, and efficiency. Let's delve into the numbers and unveil the key aspects of Archean Chemical's success through a comprehensive GPE analysis.

1. Sales Growth: The Engine of Expansion

1. Sales Growth: The Engine of Expansion

Archean Chemical has been on a meteoric rise, with a 33% 3-year CAGR in sales, surpassing its peer group median by an impressive 12 percentage points. Even over a 5-year horizon, the company continues to outpace the competition, boasting a 27% CAGR, once again 12 percentage points higher than the median. This unparalleled sales growth signifies Archean Chemical's robust market presence and strategic positioning.

2. Profits: A Tale of Exponential Growth

Profits tell a compelling story of Archean Chemical's financial prowess. The company's 3-year CAGR in profits is an astounding 133%, dwarfing the peer group median by a staggering 113 percentage points. Over 5 years, the trend persists, with a 47% CAGR, a significant 28 percentage points higher than the median. Archean Chemical's profitability not only sets it apart but also paints a picture of strategic decision-making and operational excellence.

3. Return on Capital Employed (ROCE): Maximizing Efficiency

Archean Chemical's efficient use of capital is evident in its ROCE metrics. The 3-year average of 36% is a noteworthy 15 percentage points higher than the peer group median, showcasing the company's ability to generate returns on invested capital. Over a 5-year period, Archean Chemical maintains its superiority with a 25% average ROCE, 5 percentage points higher than the median. These figures underscore the company's commitment to maximizing efficiency and shareholder value.

4. Return on Equity (ROE): Rewarding Stakeholders

Archean Chemical stands as a beacon of shareholder value creation, with a 60% 3-year average ROE, an impressive 44 percentage points higher than the peer group median. Over 5 years, the trend continues, as Archean Chemical maintains a 48% average ROE, outshining the median by 32 percentage points. The company's dedication to delivering robust returns to its stakeholders is evident in these compelling ROE figures.

5. Return on Assets (ROA): Balancing Efficiency and Utilization

While Archean Chemical's 3-year average ROA of 13% is 4 percentage points higher than the peer group median, the 5-year average of 6% is 3 percentage points lower. This dichotomy suggests a nuanced approach, highlighting the company's focus on balancing efficiency and asset utilization over different time horizons.

6. Earnings Per Share (EPS) Growth: Nurturing Investor Confidence

Archean Chemical's commitment to shareholder value is further accentuated by its robust EPS growth. The 54% 3-year growth rate is an impressive 37 percentage points higher than the peer group median, reflecting the company's ability to translate growth into tangible earnings for investors. Over 5 years, Archean Chemical maintains this trend with a 19% growth rate, 5 percentage points higher than the median.

7. Operating Margin: The Power of Operational Excellence

Archean Chemical's 5-year average operating margin of 35% is a testament to its operational excellence, surpassing the peer group median by a substantial 20 percentage points. This stellar performance underscores the company's efficiency in managing costs and optimizing operational processes.

In conclusion, Archean Chemical's GPE analysis paints a vivid picture of a company not just thriving but leading in key performance metrics. As investors contemplate the future, these robust numbers position Archean Chemical as a standout choice, poised for sustained success in the chemical industry.

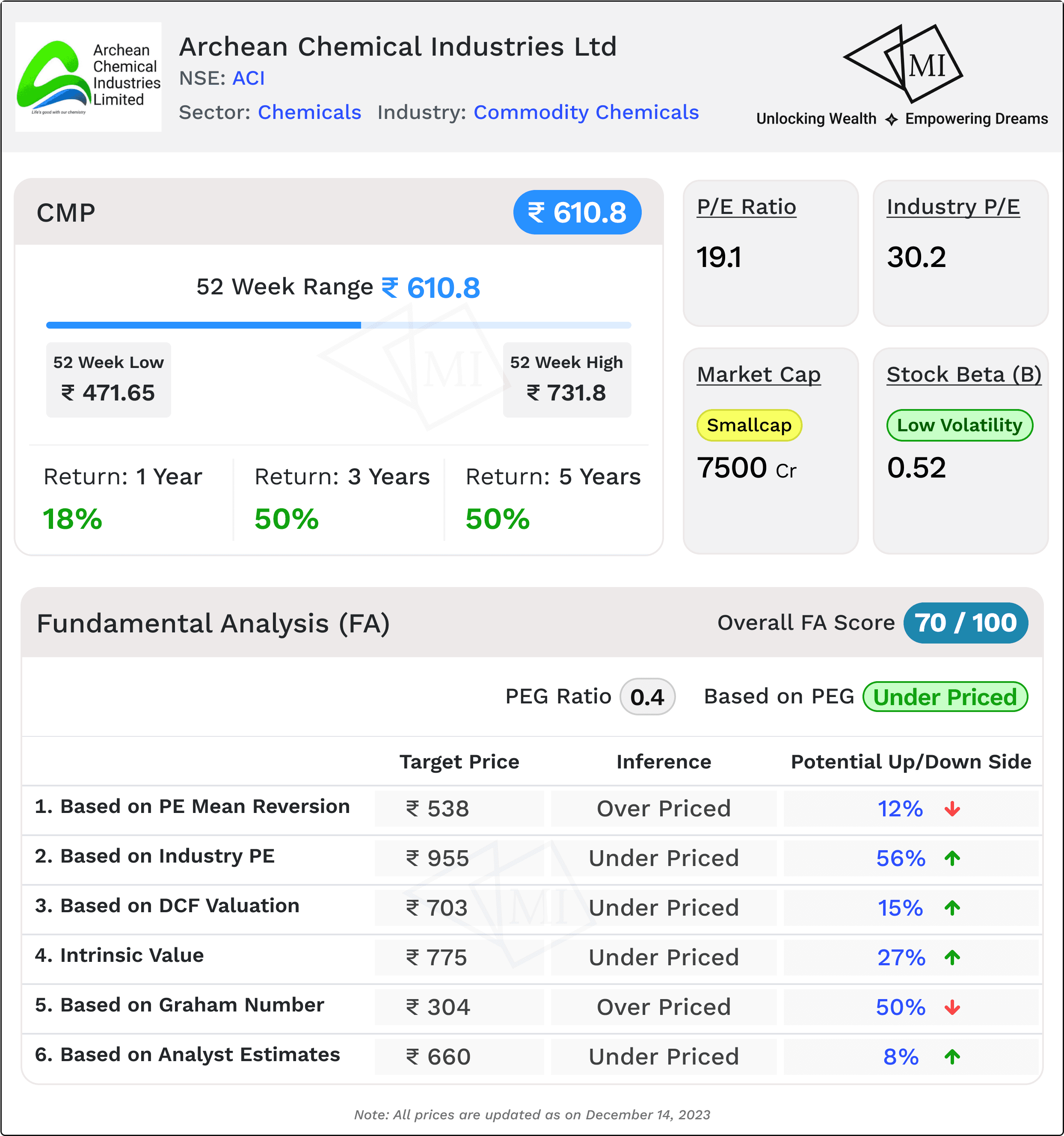

Fundamental Analysis (FA) of Archean Chemical

In the intricate world of stocks, the journey towards intelligent investment begins with a thorough exploration of fundamentals. Let's embark on this journey as we dissect the fundamental analysis of Archean Chemical, unravelling key insights that could shape your investment decisions.

1. Current Market Price: INR 610

1. Current Market Price: INR 610

At the present market price of INR 610, Archean Chemical stands as an intriguing prospect. But as savvy investors know, the current price is just the starting point of our analysis. Let's delve into a more detailed examination.

2. PEG Ratio: 0.4 (Inference: Stock is Underpriced)

The PEG ratio, standing at a tantalizing 0.4, signals a potential underpricing of Archean Chemical's stock. This metric, which considers both earnings growth and valuation, suggests that the market may not be fully appreciating the company's growth potential.

3. Expected Share Price based on PE Mean Reversion: INR 538 (Inference: Potential Downside of 12%)

Analyzing the share price through the lens of PE mean reversion, we find an expected value of INR 538 for Archean Chemical, implying a downside potential of 12%. This cautionary note suggests that the current market sentiment might be overlooking some crucial factors.

4. Expected Share Price based on Industry PE: INR 955 (Inference: Potential Upside of 56%)

Contrarily, evaluating the share price against industry PE paints a more optimistic picture. With an expected value of INR 955, the Archean Chemical stock appears underpriced, carrying a potential upside of a substantial 56%. This perspective invites a closer examination of Archean Chemical's position within its industry.

5. Fair Value as per DCF Valuation (Base Case Scenario): INR 703 (Inference: Potential Upside of 15%)

Turning our attention to the discounted cash flow (DCF) valuation in a base-case scenario, Archean Chemical's fair value emerges at INR 703. This indicates an underpriced status with a potential upside of 15%, reinforcing the narrative of undervaluation.

6. Intrinsic Value (Base Case Scenario): INR 775 (Inference: Potential Upside of 27%)

Delving into the intrinsic value of the stock within the base-case scenario, we discover a value of INR 775 for Archean Chemical. This intrinsic assessment underscores a substantial underpricing, presenting an enticing potential upside of 27%.

7. Fair Value as per Graham Number: INR 304 (Inference: Potential Downside of 50%)

However, the Graham Number, calculated at INR 304, tells a different story for Archean Chemical. This metric suggests a potential downside of 50%, indicating that caution may be warranted.

8. Average Target Price as per Analyst Estimate: INR 660 (Inference: Potential Upside of 8%)

Lastly, aggregating insights from analyst estimates, the average target price for Archean Chemical lands at INR 660. This implies a potential upside of 8%, providing a modestly optimistic outlook.

In conclusion, the fundamental analysis of Archean Chemical reveals a tapestry of varying perspectives. While certain metrics signal an undervalued gem, others caution against overlooking potential risks. As you navigate the investment landscape, a balanced consideration of these fundamental indicators will empower you to make informed and strategic decisions.

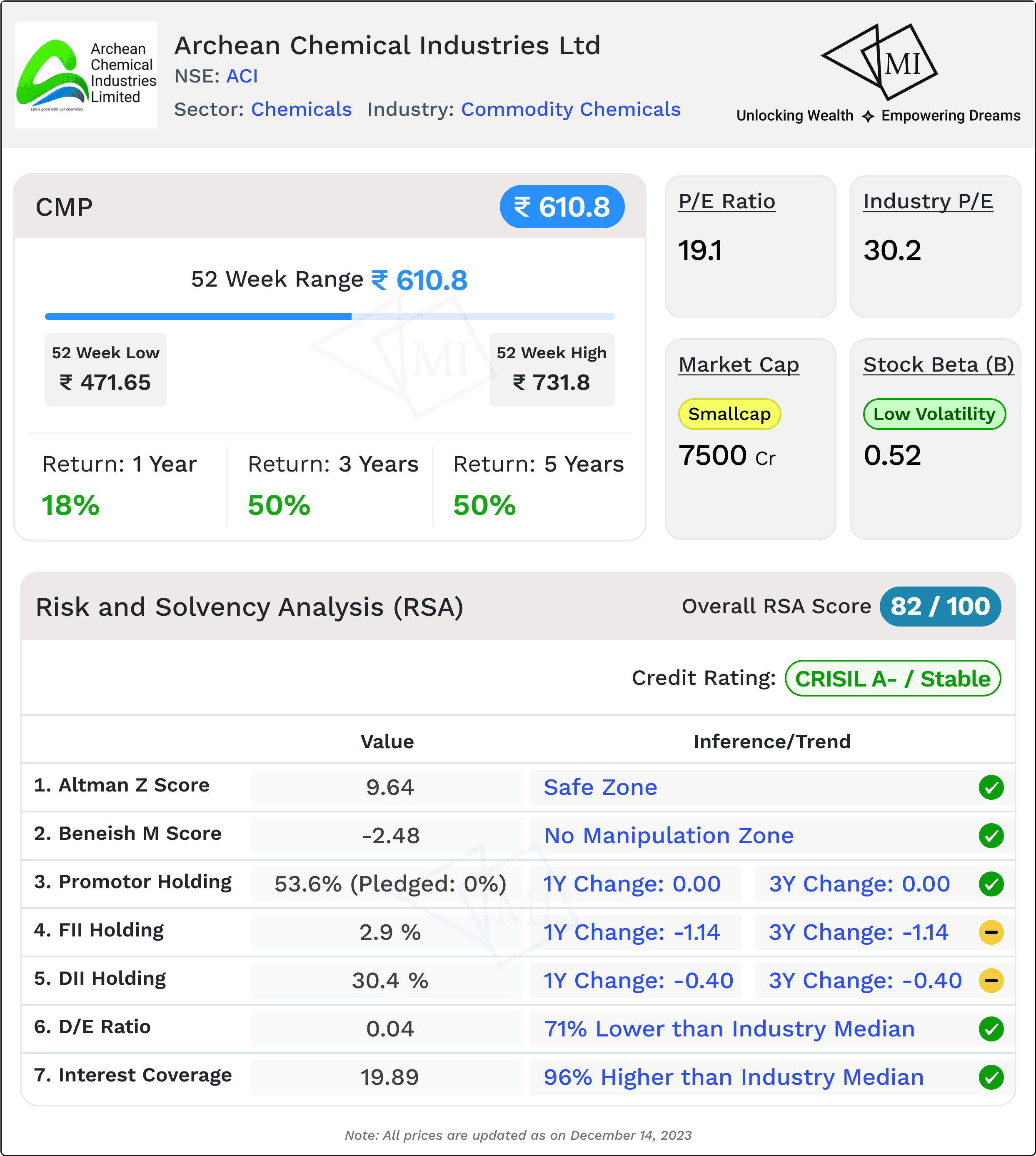

Risk and Solvency Analysis (RSA) of Archean Chemical

In the dynamic realm of stock markets, understanding the risk landscape and evaluating solvency is crucial for informed investment decisions. Let's embark on a journey of Risk and Solvency Analysis for Archean Chemical, decoding key indicators that unveil the company's financial fortitude and potential risks.

1. Stock Beta: 0.52 (Low Volatility)

1. Stock Beta: 0.52 (Low Volatility)

Archean Chemical's stock Beta of 0.52 signals low volatility compared to the market. This characteristic can be reassuring for investors seeking stability, as the stock is less susceptible to market fluctuations.

2. Long Term Credit Rating: CRISIL A-/Stable

The CRISIL A-/Stable credit rating reflects Archean Chemical's strong creditworthiness. This rating suggests a relatively low credit risk and a stable outlook, adding a layer of confidence for potential investors.

3. Altman Z Score: 9.64 (Safe Zone)

Archean Chemical comfortably resides in the "Safe Zone" with an Altman Z Score of 9.64. This metric, which assesses bankruptcy risk, indicates a robust financial position and lower likelihood of financial distress.

4. Beneish M Score: -2.48 (No Manipulation Zone)

The Beneish M Score of -2.48 places Archean Chemical comfortably in the "No Manipulation Zone." This negative score suggests a lower probability of financial manipulation, providing a reassuring signal for investors.

5. Promoter Holding: 53.6% (0% Pledged, 1Y Change: 0, 3Y Change: 0)

Archean Chemical's stable Promoter Holding at 53.6%, with no pledged shares, reflects a commitment to the company's long-term success. The absence of significant changes in promoter holding over 1 and 3 years further indicates stability and confidence in the business.

6. FII Holding: 2.9% (1Y Change: -1.14, 3Y Change: -1.14)

While Foreign Institutional Investors (FIIs) hold a modest 2.9% stake, a decrease of -1.14% over both 1 and 3 years might warrant further investigation. Understanding the rationale behind this decrease is crucial for assessing the perceived risk by institutional investors.

7. DII Holding: 30.4% (1Y Change: -0.40, 3Y Change: -0.40)

Domestic Institutional Investors (DIIs) maintain a substantial 30.4% holding in Archean Chemical. Although there has been a minor decrease of -0.40% over 1 and 3 years, the overall holding remains significant, showcasing continued interest from domestic institutions.

8. D/E Ratio: 0.04 (71% Lower than Industry Median of 0.14)

With an impressively low Debt-to-Equity (D/E) ratio of 0.04, Archean Chemical demonstrates prudent financial management. This ratio, significantly lower than the industry median, signals a conservative approach to debt, minimizing financial risk.

9. Interest Coverage Ratio (ICR): 19.89 (96% Higher than Industry Median of 10.15)

The Interest Coverage Ratio (ICR) at 19.89 positions Archean Chemical as financially robust. This ratio, significantly higher than the industry median, suggests the company has a comfortable buffer to meet its interest obligations.

In conclusion, Archean Chemical emerges as a sturdy contender, backed by low volatility, strong credit ratings, and robust solvency indicators. While the decrease in FII and DII holdings warrants attention, the company's financial stability, low debt exposure, and healthy interest coverage position it favourably in the market landscape.

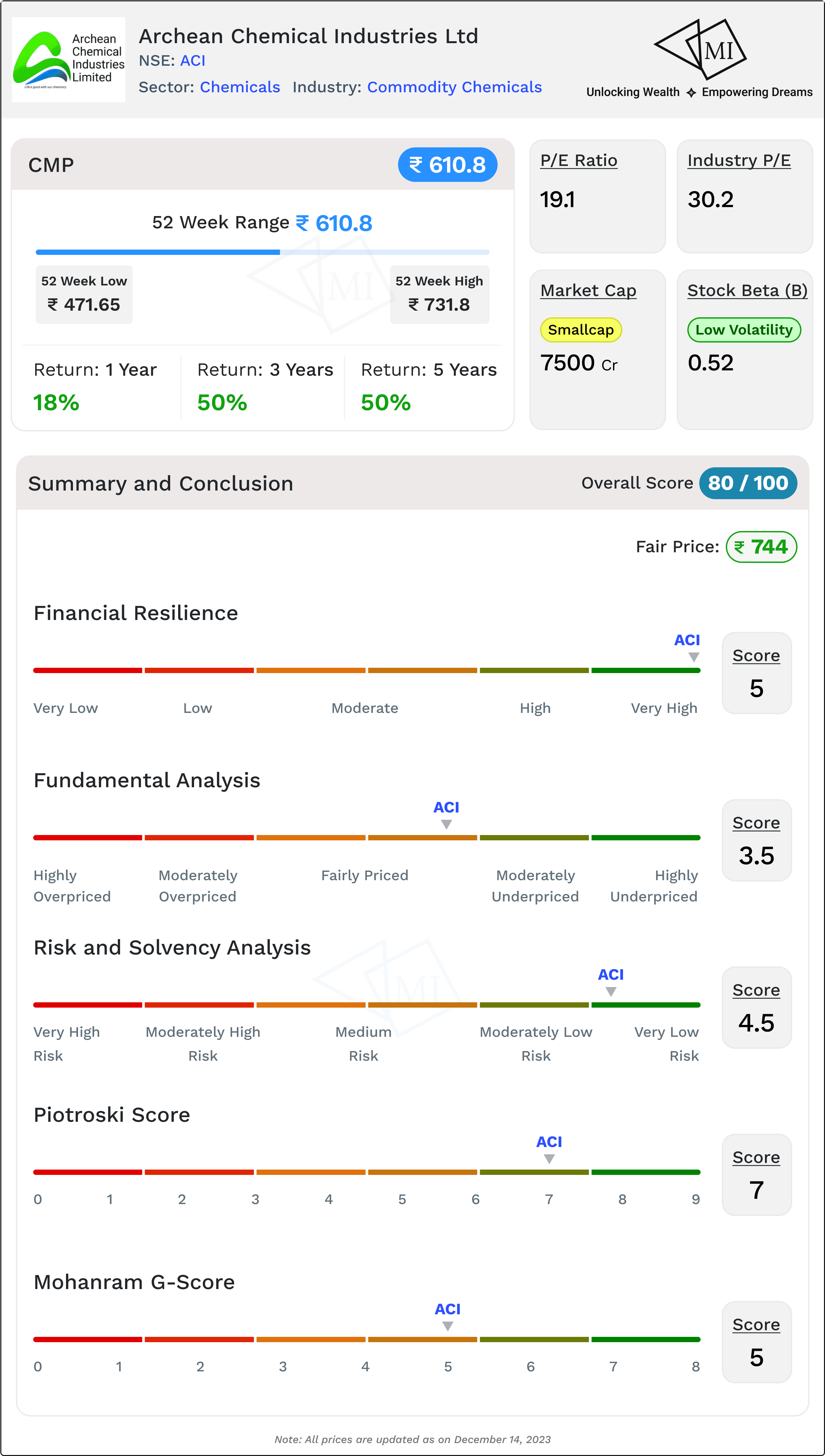

Summary and Conclusion: Recap and Final Thoughts on Archean Chemical

In the intricate world of stock analysis, Archean Chemical emerges as a compelling narrative of financial robustness and growth potential. As we distill the wealth of information from our exploration into Archean Chemical's Financial Resilience, Fundamental Analysis, and Risk and Solvency, a comprehensive view of the stock's health comes into focus.

1. Financial Resilience: A Perfect Score of 5 on 5

1. Financial Resilience: A Perfect Score of 5 on 5

Archean Chemical stands tall with a perfect Financial Resilience Score of 5 on 5. This stellar performance underscores the company's ability to weather economic uncertainties, showcasing a robust financial foundation that instills confidence in investors.

2. Fundamental Analysis: A Score of 3.5 on 5

Our Fundamental Analysis of Archean Chemical yields a score of 3.5 on 5, indicating a solid foundation but with room for improvement. While the company exhibits strength in various fundamental aspects, there are areas where strategic enhancements could further elevate its standing.

3. Risk and Solvency Analysis: A Score of 4.5 on 5

Archean Chemical excels in our Risk and Solvency Analysis, securing an impressive score of 4.5 on 5. This high score reflects the company's adept risk management practices and robust solvency, positioning it as a stable and secure investment.

4. Piotroski Score: An Impressive 7 (High)

The Piotroski Score, standing at a commendable 7, signals high financial strength and operational efficiency for Archean Chemical. This score reflects the company's ability to generate profits, maintain healthy financials, and exhibit positive operating trends.

5. Mohanram G-Score: A Solid 5 (Average)

With a Mohanram G-Score of 5, Archean Chemical maintains an average standing. While this score indicates moderate financial distress risk, it's important to consider it in conjunction with the overall financial health and resilience demonstrated by the company.

Overall Score: 80 on 100, Fair Price for Stock: INR 744

Aggregating our scores and insights, Archean Chemical achieves an impressive overall score of 80 on 100. This comprehensive evaluation positions the company as a promising investment opportunity. The calculated fair price for the stock, at INR 744, suggests an upward potential from the current market price of INR 610.

Conclusion: Navigating Growth with Confidence

In conclusion, Archean Chemical emerges as a formidable player in the market, backed by a sturdy financial foundation, robust risk management practices, and growth potential. While our analysis indicates areas for refinement, the overall outlook is optimistic. Investors, considering Archean Chemical as a part of their portfolio, may find a compelling opportunity for long-term growth and stability. As with any investment decision, it's prudent to stay vigilant, continuously monitor market dynamics, and make informed choices based on evolving circumstances.

Information on Multibagger Investments is for educational purposes only and should not be considered financial advice. Users should conduct their own research and seek professional advice before making investment decisions.