157% Return in 3 Years. Is IDFC First Bank share good to buy for long term?

Introduction

In the intricate tapestry of India's banking landscape, IDFC First Bank emerges as a transformative force, crafting its narrative through strategic mergers and a dynamic shift in focus. Established on December 18, 2018, through the amalgamation of Erstwhile IDFC Bank and Erstwhile Capital First, the bank has evolved as a prominent player in the financial realm.

Key Points: Illuminating Financial Soundness

Ratios for the first three quarters of FY23 shed light on the bank's robust financial standing:

- Capital Adequacy Ratio: A formidable 16.06%, signalling a sturdy capital foundation.

- Net Interest Margin: A commendable 6.36%, showcasing the bank's profitability in managing interest-bearing assets.

- Gross NPA: A modest 2.96%, reflecting disciplined asset quality management.

- Net NPA: A low 1.03%, underscoring the bank's efficacy in curbing non-performing assets.

- CASA Ratio: A remarkable 50%, emphasizing a strong Current and Savings Account base.

Branch Network: Weaving a Pan-India Presence

With a current footprint of 809 branches and 925 ATMs spread across India, IDFC First Bank ensures its services reach far and wide, fostering financial inclusion.

Transformation and Business Scaling: A Strategic Shift

The bank is undergoing a transformative journey, transitioning from a corporate-focused, low Net Interest Margin (NIM) institution to a retail-focused, high NIM entity. Scaling up its operations during FY22, the bank has ventured into diverse financial services, embracing digital solutions, trade forex, wealth management, and credit cards.

Liabilities and Assets Restructuring: A Paradigm Shift

The bank's liability side showcases a remarkable shift, with the CASA ratio soaring from ~9% in Dec '19 to a robust ~48% in March '22. Core deposits have burgeoned to constitute 73% of total customer deposits, a testament to the bank's strategic financial management.

On the assets side, the bank has strategically reduced exposure to infrastructure loans, aiming for nil by FY24/25. Retail and commercial loans now constitute a substantial 72% of total funded assets, enhancing the bank's risk profile.

Profitability and Asset Quality: A Balancing Act

The bank's efforts reflect positively in its Net Interest Margins, escalating from ~3% in FY19 to ~6% in FY22. Management envisions further improvement to 5-5.5% by FY24/25, affirming a commitment to sustained profitability.

Asset quality, as of FY22, exhibits resilience, with Gross NPA ratio at 3.70% and Net NPA ratio at 1.53%. Notably, the Retail and Commercial Finance Book witnessed significant improvements in NPA ratios, showcasing the bank's proactive risk management.

In essence, IDFC First Bank's journey is a testament to adaptability and strategic foresight, positioning it as a formidable force in the ever-evolving banking landscape. As we delve deeper into the bank's facets, the subsequent sections will unravel its trajectory, offering insights into its share price target and future prospects.

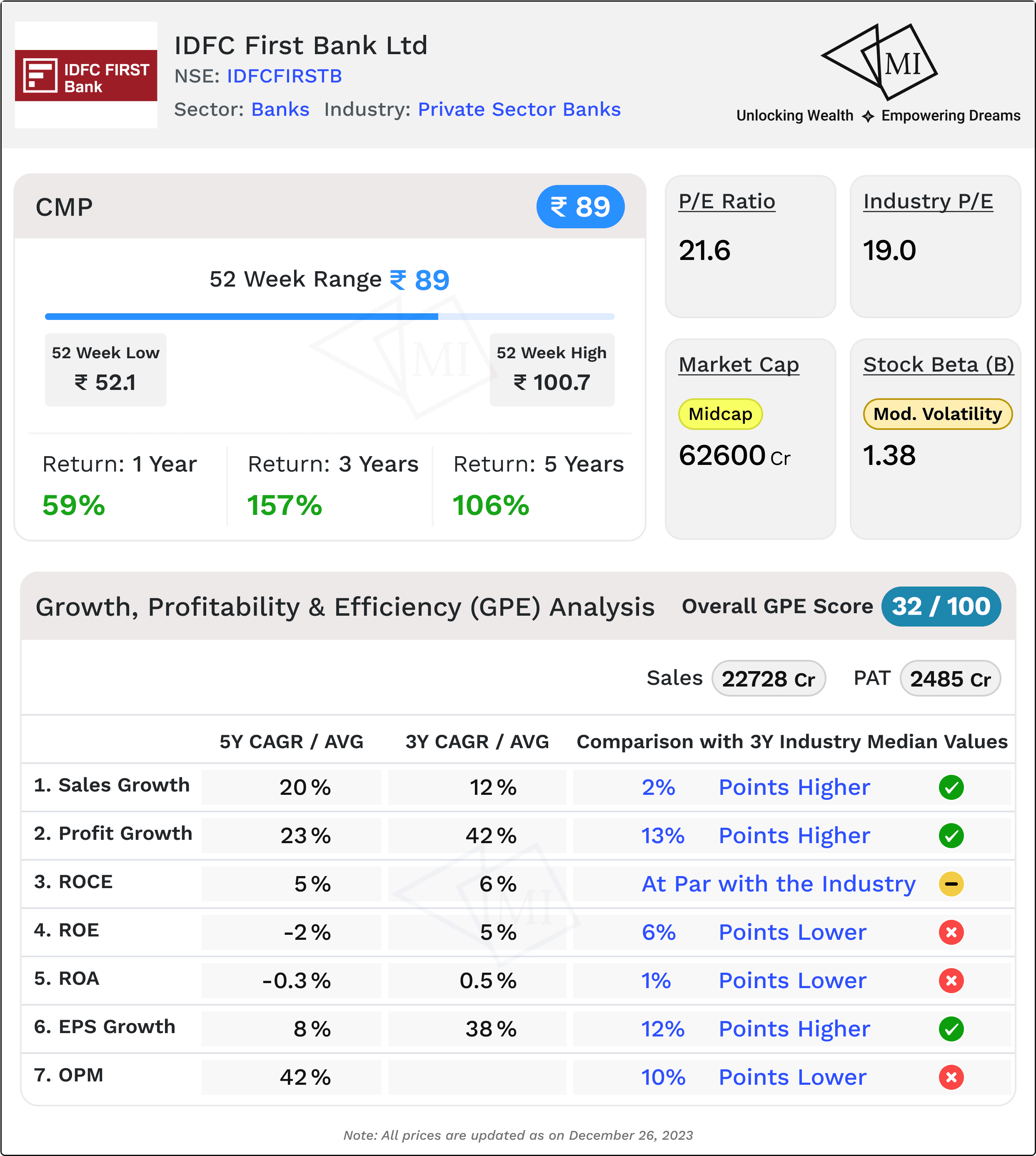

Growth, Profitability, and Efficiency (GPE) Analysis of IDFC First Bank

In the dynamic world of banking and finance, understanding a financial institution's Growth, Profitability, and Efficiency (GPE) metrics is crucial for investors seeking insight into its performance and potential. Let's delve into the GPE analysis for IDFC First Bank, comparing key indicators against its peer group, to decipher the bank's trajectory.

1. Sales Growth: Impressive Trajectory

IDFC First Bank has showcased robust sales growth, with a 3-year Compound Annual Growth Rate (CAGR) of 12%, surpassing the peer group median by 2 percentage points. The 5-year CAGR of 20% maintains this momentum, standing 8 percentage points higher than the median. This reflects the bank's effective strategies in expanding its market presence.

2. Profits: Mixed Picture of Performance

Profits have seen remarkable growth with a 3-year CAGR of 42%, outperforming the peer group median by a substantial 13 percentage points. However, the 5-year CAGR of 23% lags behind by 3 percentage points. This indicates a need for sustained efforts to maintain and enhance profitability.

3. Return on Capital Employed (ROCE): On Par with Peers

The ROCE for IDFC First Bank over the past 3 years averages at 6%, aligning with the peer group median. The 5-year average of 5% is marginally lower by 1 percentage point, suggesting a consistent performance in utilizing capital effectively.

4. Return on Equity (ROE): Areas for Improvement

The ROE, however, shows room for improvement. The 3-year average of 5% is 6 percentage points lower than the peer group median, and the 5-year average of -2% widens this gap to 12 percentage points. Focusing on strategies to enhance shareholder value will be essential.

5. Return on Assets (ROA): Maintaining Competitiveness

The ROA for IDFC First Bank, with a 3-year average of 0.5%, stays competitive but is 1 percentage point lower than the peer group median. The 5-year average of -0.3% mirrors this trend, indicating the need for fine-tuning operational efficiency.

6. Earnings Per Share (EPS) Growth: Varied Performance

Earnings Per Share growth has been impressive with a 3-year growth rate of 38%, surpassing the peer group median by 12 percentage points. However, the 5-year growth rate of 8% falls behind by 18 percentage points, signaling the importance of sustained momentum.

7. Operating Margin: Addressing Margin Challenges

While the 5-year average operating margin for IDFC First Bank stands at 42%, reflecting a healthy margin, it is 10 percentage points lower than the peer group median. Fine-tuning operational efficiencies will be key to addressing this disparity.

In conclusion, IDFC First Bank exhibits commendable growth and profitability metrics, outperforming peers in certain aspects. However, there are areas, such as ROE and operating margins, where improvements can enhance overall competitiveness.

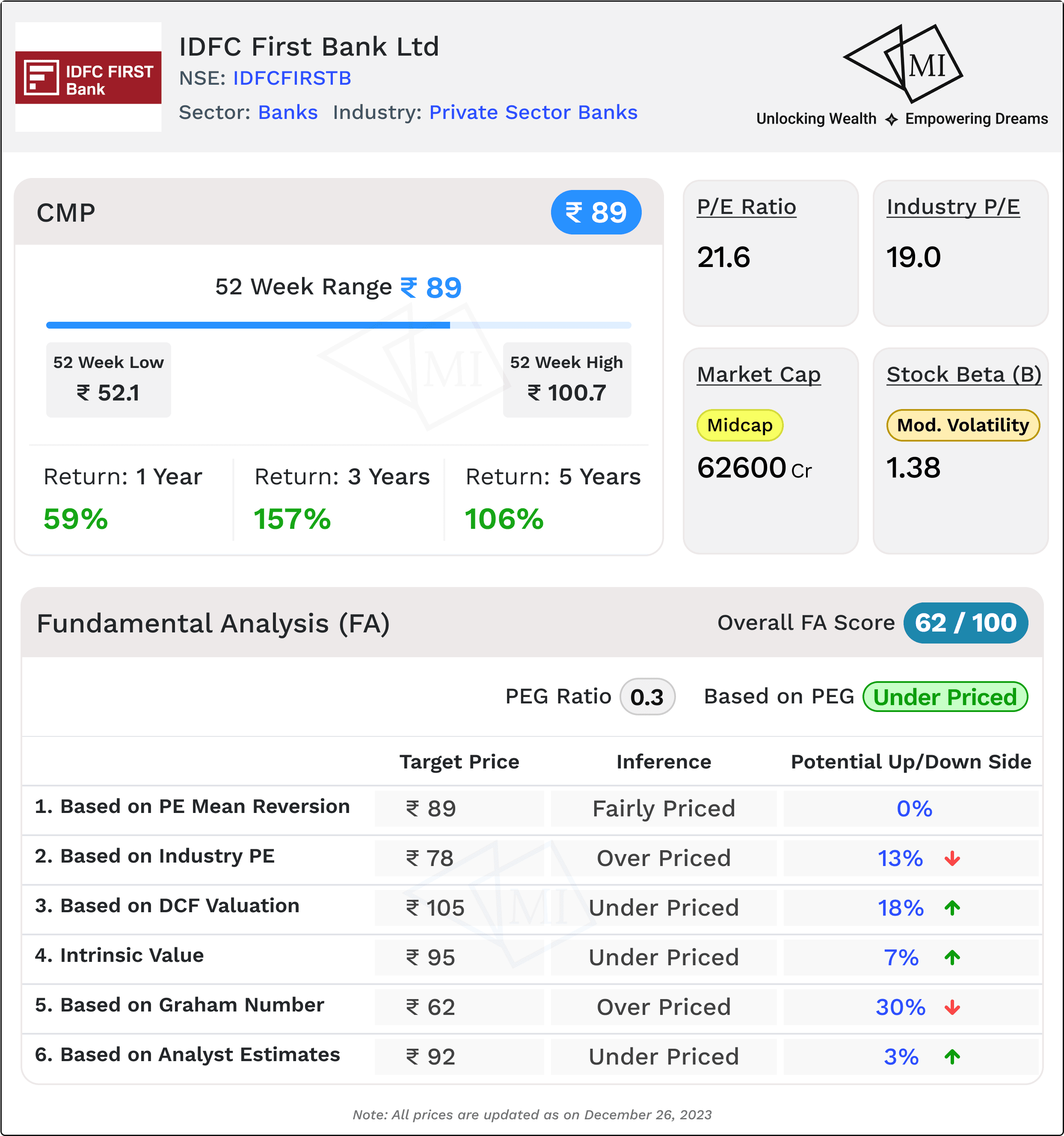

Fundamental Analysis (FA) of IDFC First Bank

Understanding the fundamental underpinnings of IDFC First Bank is paramount for investors aiming to make informed decisions in the ever-evolving financial landscape. Let's delve into the fundamental analysis, unravelling key metrics and valuation indicators that shed light on the bank's current standing and future potential.

Current Market Price: INR 89, PEG Ratio: 0.3 - A Preliminary Glance

The current market price of IDFC First Bank is at INR 89, and the PEG ratio stands impressively low at 0.3. This implies that the stock is potentially underpriced, presenting an intriguing opportunity for investors.

Expected Share Price Analysis: A Comparative Overview

1. Expected Share Price based on PE Mean Reversion: INR 89 - Fair Valuation

The expected share price for IDFC First Bank, derived from PE mean reversion, aligns with the current market price at INR 89, suggesting a fair valuation. This indicates that the stock is reasonably priced in line with historical earnings multiples.

2. Expected Share Price based on Industry PE: INR 78 - Potential Downside of 13%

In contrast, the expected share price for IDFC First Bank based on industry PE is estimated at INR 78, signalling a potential downside of 13%. According to this metric, the stock might be perceived as overpriced relative to industry peers.

3. Fair Value as per DCF Valuation: INR 105 - Potential Upside of 18%

Employing a discounted cash flow (DCF) valuation in a base-case scenario yields a fair value of INR 105 for IDFC First Bank. This suggests that the stock is potentially underpriced, presenting an enticing upside of 18% from the current market price.

4. Intrinsic Value: INR 95 - Potential Upside of 7%

Assessing the intrinsic value in a base-case scenario reveals a value of INR 95 for IDFC First Bank, indicating that the stock is underpriced with a potential upside of 7%. Investors might find this metric reassuring in terms of the stock's value.

5. Fair Value as per Graham Number: INR 62 - Potential Downside of 30%

The Graham Number, a conservative valuation metric, suggests a fair value of INR 62 for IDFC First Bank. This implies that the stock might be overpriced, presenting a potential downside of 30%.

6. Average Target Price as per Analyst Estimate: INR 92 - Potential Upside of 3%

Analyst estimates converge at an average target price of INR 92 for IDFC First Bank, indicating that the stock is underpriced with a modest potential upside of 3%. While this aligns with the underpricing trend, the upside is relatively conservative.

Synthesizing the Insights: Navigating Investment Decisions

In conclusion, the fundamental analysis paints a nuanced picture of IDFC First Bank's valuation. While some metrics suggest the stock is underpriced, others hint at a potential downside. Investors should carefully weigh these indicators, considering the dynamic nature of financial markets, to make informed decisions aligned with their risk appetite and investment goals.

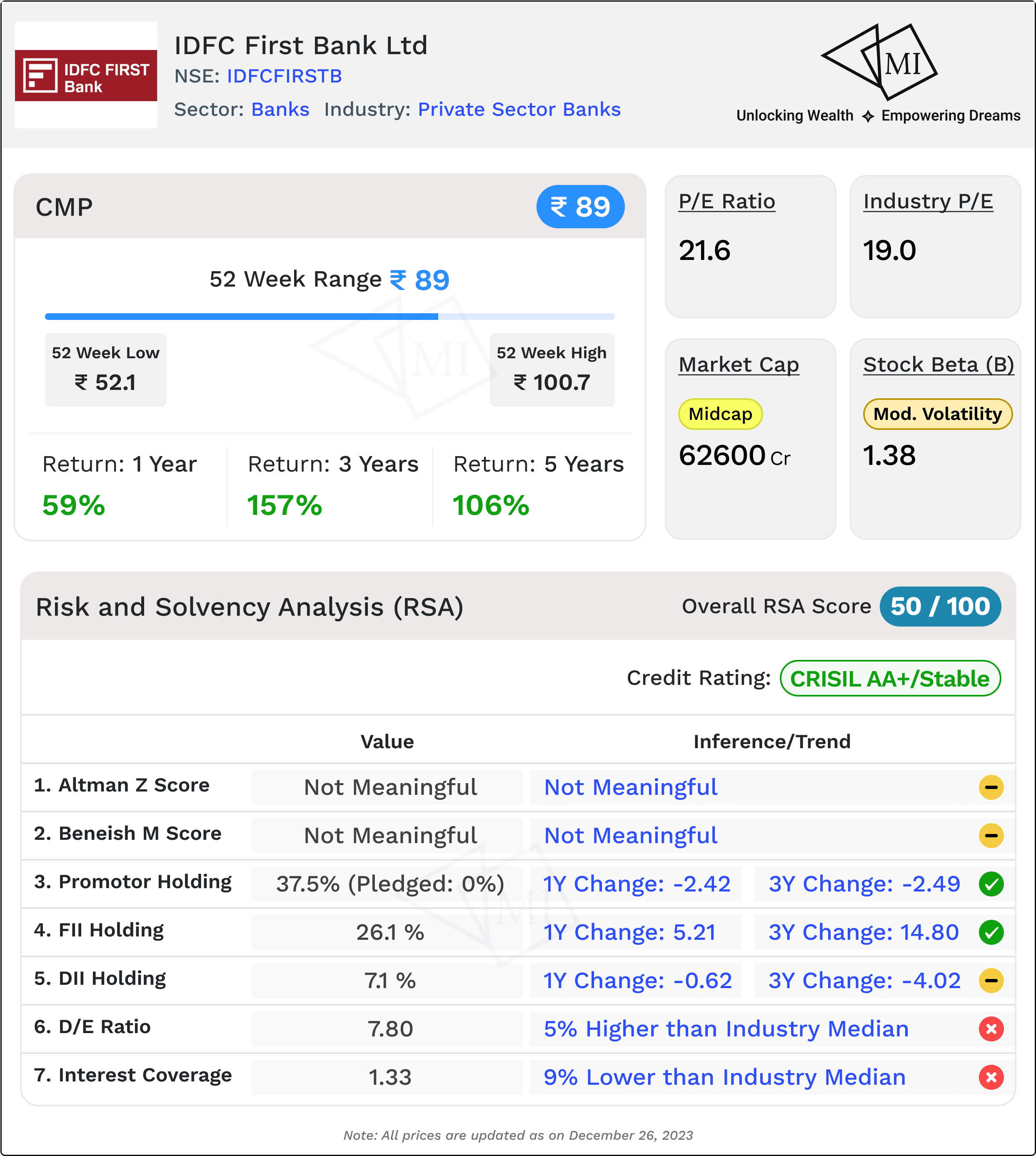

Risk and Solvency Analysis (RSA) of IDFC First Bank

In the dynamic realm of banking, evaluating the risk and solvency profile of a financial institution is paramount for investors seeking stability and resilience. Let's delve into the risk and solvency analysis for IDFC First Bank, unravelling key indicators that illuminate the bank's ability to navigate challenges and ensure financial robustness.

1. Stock Beta: 1.38 - Moderate Volatility

IDFC First Bank exhibits a Stock Beta of 1.38, signifying moderate volatility. Investors should be aware of potential price fluctuations associated with this level of beta, indicating a moderate sensitivity to market movements.

2. Long Term Credit Rating: CRISIL AA+/Stable - A Sign of Stability

The bank boasts a Long Term Credit Rating of CRISIL AA+/Stable, highlighting a robust credit standing. This rating, denoting a high degree of safety regarding timely servicing of financial obligations, provides assurance to stakeholders.

3. Altman Z Score: 0.96 - Not Meaningful for Banks

The Altman Z Score, commonly used for non-financial companies, is not considered meaningful for banks. As such, alternative metrics tailored to the banking sector should be relied upon for a comprehensive solvency assessment.

4. Beneish M Score: Not Estimated - Not Meaningful for Banks

Similar to the Altman Z Score, the Beneish M Score is not estimated for banks. Investors should focus on relevant indicators specific to the banking sector for a comprehensive solvency analysis.

5. Promoter Holding: 37.5% (0% Pledged)

IDFC First Bank maintains a robust Promoter Holding of 37.5%, with no shares pledged. While the 1-year and 3-year changes in promoter holding indicate a slight decrease, the stability of the holding reflects a sustained commitment from promoters.

6. FII Holding: 26.1% (1Y Change: 5.21%, 3Y Change: 14.80%)

Foreign Institutional Investors (FIIs) hold a significant stake of 26.1% in IDFC First Bank. The positive 1-year and 3-year changes in FII holding signify foreign investor confidence in the bank's prospects.

7. DII Holding: 7.1% (1Y Change: -0.62%, 3Y Change: -4.02%)

Domestic Institutional Investors (DIIs) have a comparatively smaller holding of 7.1%. The marginal decrease in the 1-year and 3-year changes in DII holding suggests a nuanced sentiment among domestic institutional investors.

8. D/E Ratio: 7.8 - Slightly Higher than Industry Median

The Debt-to-Equity (D/E) Ratio for IDFC First Bank stands at 7.8, which is 5% higher than the industry median value of 7.42. While indicating a significant debt burden, it's important to note that it is slightly above industry norms.

9. Interest Coverage Ratio: 1.33 - Slightly Lower than Industry Median

The Interest Coverage Ratio (ICR) at 1.33 is 9% lower than the industry median of 1.46. This suggests a slightly lower capacity for IDFC First Bank to cover its interest obligations, warranting attention to debt management strategies.

In conclusion, IDFC First Bank presents a mix of positive and concerning indicators in its risk and solvency profile. While credit ratings, stable promoter holding, and foreign investor confidence are strengths, slightly elevated debt levels and a lower interest coverage ratio pose areas for careful consideration.

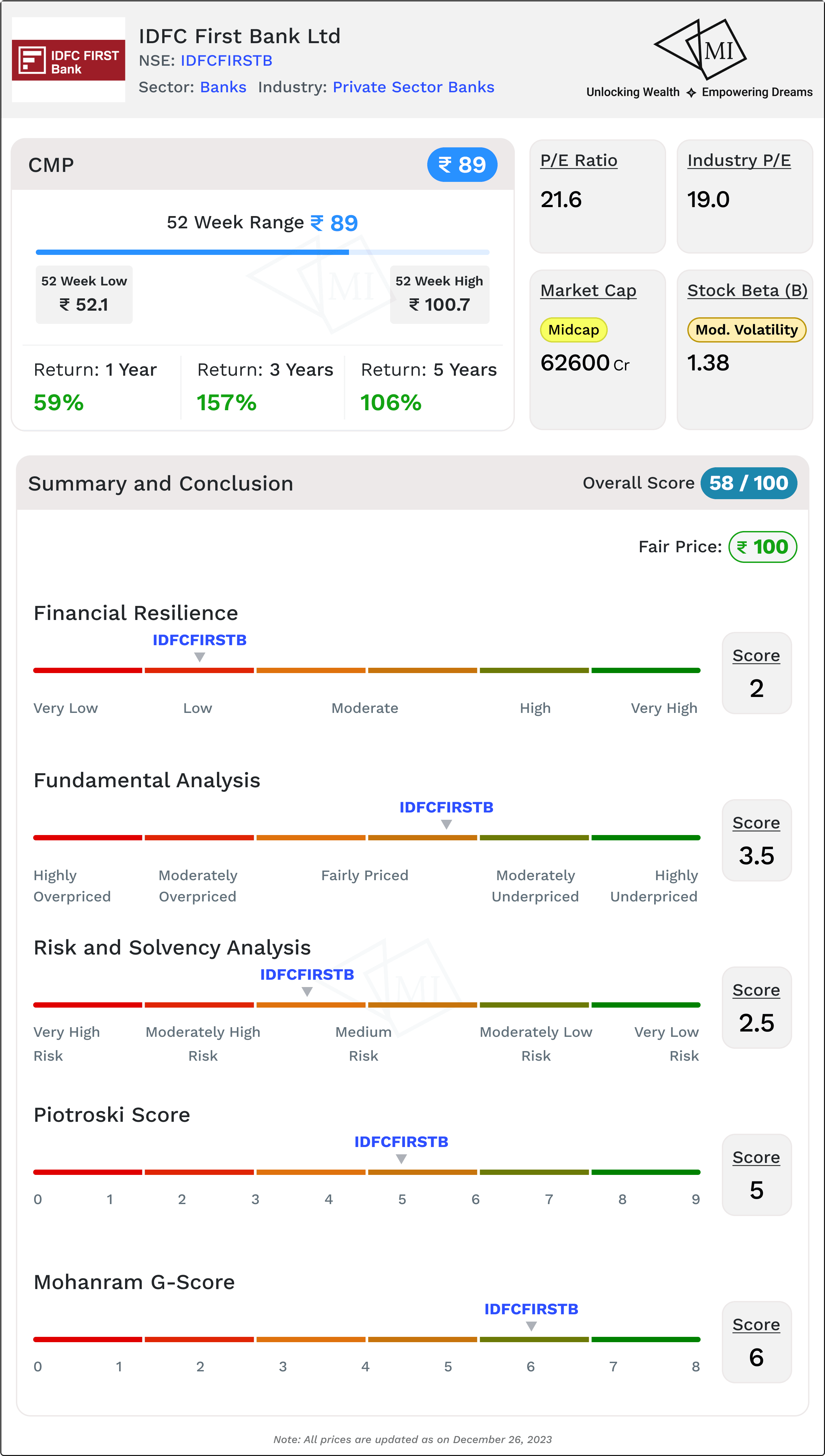

Summary and Conclusion: Recap and Final Thoughts on IDFC First Bank

As investors seek a compass through the dynamic landscape of financial markets, a comprehensive evaluation of IDFC First Bank unveils a tapestry of strengths and considerations. Let's distill the analysis into key scores and insights to guide investment decisions.

1. Financial Resilience Score: 2 on 5

IDFC First Bank demonstrates a moderate financial resilience score, reflecting a stable yet evolving financial position. While not the highest, this score suggests a foundation that can weather challenges with strategic management.

2. Fundamental Analysis Score: 3.5 on 5

The fundamental analysis score positions IDFC First Bank as a solid contender, garnering 3.5 out of 5. This signifies a commendable performance in key financial metrics, providing a strong foundation for sustainable growth.

3. Risk and Solvency Analysis Score: 2.5 on 5

The risk and solvency analysis score for IDFC First Bank stands at 2.5 out of 5, indicating a moderate risk profile. Investors should be mindful of factors such as debt levels and interest coverage while assessing the bank's ability to navigate uncertainties.

4. Piotroski Score: 5 (Average)

The Piotroski Score, a measure of financial health, stands at 5, marking an average score. This suggests a balanced performance across various financial criteria, reflecting stability in the bank's operational and financial metrics.

5. Mohanram G-Score: 6 (High)

The Mohanram G-Score for IDFC First Bank is 6, signaling a high score. This reflects positively on the bank's overall financial strength, affirming its ability to generate consistent earnings.

Overall Composite Score: 58 on 100 The amalgamation of financial resilience, fundamental analysis, and risk and solvency analysis culminates in an overall score of 58 out of 100 for IDFC First Bank. This score encapsulates the bank's performance across various dimensions, providing investors with a comprehensive gauge of its current standing.

Fair Price for Stock: INR 100 (Current Market Price: INR 89)

Considering the overall evaluation, the fair price for IDFC First Bank's stock is projected at INR 100. This implies that the stock is currently undervalued relative to its fair intrinsic value, presenting a potential upside for investors.

In conclusion, IDFC First Bank emerges as a promising investment opportunity with a balanced financial standing, strategic management, and growth potential. However, investors are advised to exercise diligence, keeping an eye on evolving market dynamics and the bank's response to industry challenges. The provided insights aim to empower investors with a well-rounded perspective, aiding them in making informed decisions in the dynamic world of banking and finance.

Information on Multibagger Investments is for educational purposes only and should not be considered financial advice. Users should conduct their own research and seek professional advice before making investment decisions.

Frequently Asked Questions

সম্পর্কিত নিবন্ধ

22% Return in 3 Years. Is Yes Bank share worth buying?

Nearing 52 Week Low Mark. Is it Good Time to Buy Adani Wilmar Share?